Sophia’s Thoughts On Who’s Buying the Bitcoin

While some corporations are doubling down on Bitcoin with record-breaking purchases, others remain on the sidelines. What does this divide mean for the future of crypto?

These are Sophia's Thoughts:

MicroStrategy, Marathon Digital, and ETF investors are buying Bitcoin hand over fist, catalyzing the rally and showcasing Bitcoin’s utility as an institutional asset.

While Bitcoin gains traction among some, major corporations like Microsoft and Amazon remain cautious, highlighting the volatility and regulatory uncertainty.

The contrast between adopters and skeptics underscores Bitcoin’s dual role as both a transformative asset and a contentious investment opportunity.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

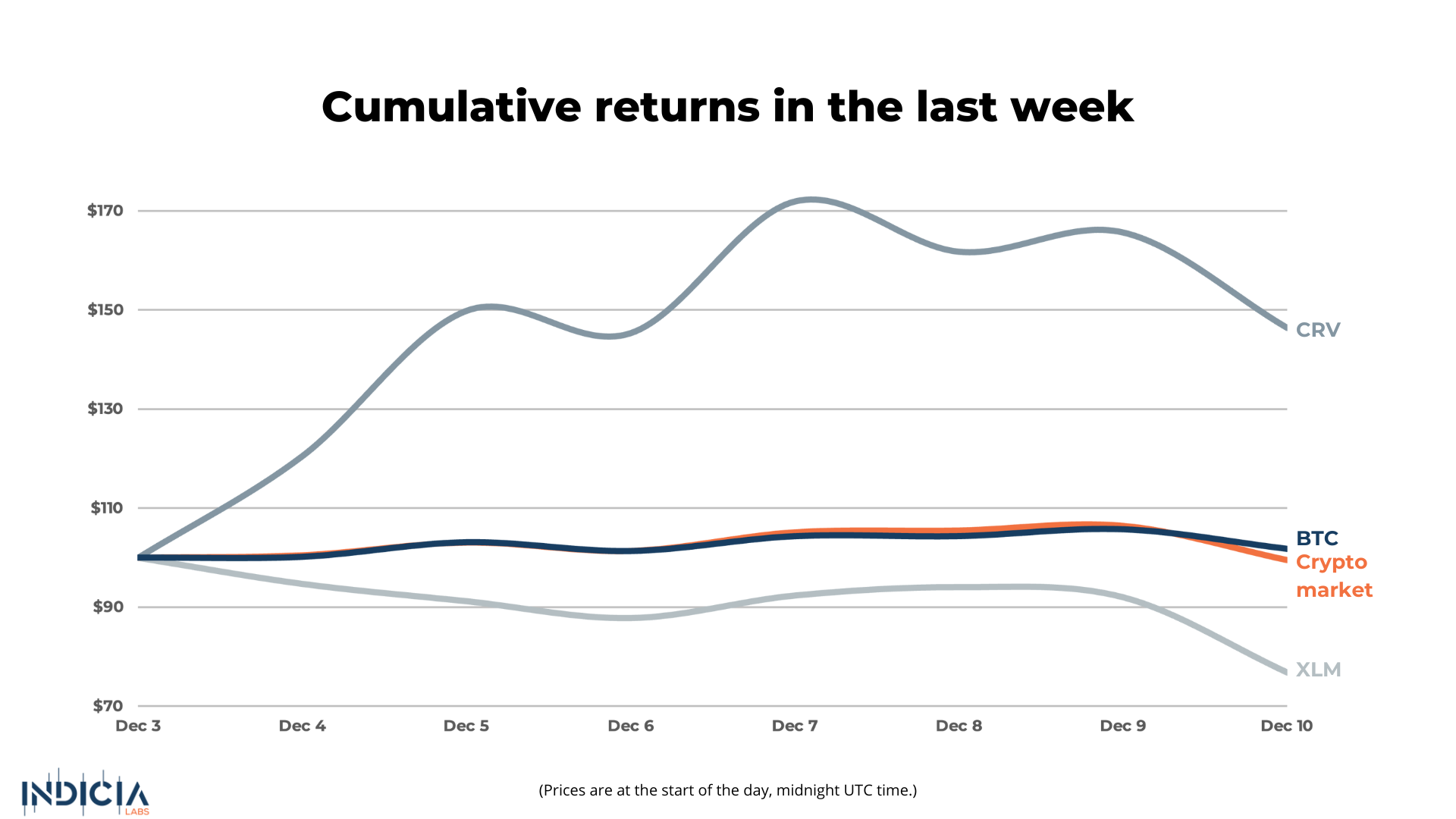

The market finally took a breather after an incredible multi-week really, chopping sideways and in the end, falling 0.5%. Bitcoin (BTC) outperformed the broader market, gaining 1.0%. The best performing coin of the week was Curve DAO (CRV), rising 46.4%. The worst performing coin this week was Stellar (XLM) which fell 23.2% as it cooled off from a 200%+ move up last month.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

💰 Who’s Buying Bitcoin?

MicroStrategy (MSTR), the largest corporate Bitcoin holder, continues to dominate headlines with its relentless accumulation strategy. The company acquired an additional 21,550 BTC for USD 2.1 billion this week, bringing its total holdings to an unprecedented 423,650 BTC worth over USD 40 billion. This purchase is part of MicroStrategy’s ambitious “21/21 Plan,” which aims to accumulate USD 42 billion worth of Bitcoin over three years. Founder Michael Saylor remains unwaveringly bullish, predicting a potential long-term Bitcoin price of USD 13 million in his best-case scenario by 2045.

Following closely, Marathon Digital Holdings (MARA) has solidified its position as another key corporate player. The Bitcoin mining giant added 11,774 BTC to its treasury at a total cost of USD 1.1 billion on the 9th, bringing its total holdings to 40,435 BTC valued at USD ~3.9 billion. MARA’s purchase was made at an average price of USD 96,000 per Bitcoin, funded through zero-coupon convertible notes. With a year-to-date Bitcoin yield of 47.6% (Bitcoin holdings per share) and quarter-to-date yield of 12.3%, Marathon’s timing and aggressive accumulation have drawn attention as more and more companies follow the Microstrategy playbook.

Institutional flows into Bitcoin ETFs have also provided substantial momentum for the market. Last week alone, U.S.-listed ETFs absorbed over 28,000 BTC—an amount equivalent to 62 days of Bitcoin issuance—amounting to USD ~2.7 billion in inflows. BlackRock’s IBIT led the charge with record-breaking daily contributions:

Meanwhile, corporate holders like Tesla, Riot Platforms, and CleanSpark remain steadfast in their positions. Tesla holds 9,720 BTC valued at approximately USD 927 million, signaling its quiet confidence in Bitcoin as a long-term asset. Similarly, mining giants Riot Platforms holds 10,019 BTC while CleanSpark has accumulated 9,297 BTC, reflecting their ongoing commitment to integrating Bitcoin into their operations. These moves combined with the surge in ETF inflows paint a clear picture: Bitcoin is no longer just a speculative asset but a cornerstone of institutional and corporate strategy.

✖ Who Isn’t Buying Bitcoin?

While major players like MicroStrategy, Marathon Digital, and ETF investors are fueling Bitcoin’s rally, not every corporate giant is eager to join the party. This week, Microsoft made headlines for rejecting a shareholder proposal to allocate between 1% and 5% of its profits to Bitcoin. The proposal, presented by the National Center for Public Policy Research (NCPPR), emphasized Bitcoin’s potential to diversify profits and act as a hedge against inflation. Michael Saylor spoke to the Microsoft board as well, ending his presentation saying: "Do the right thing for your customers, employees, shareholders, the country, the world, and your legacy…Adopt Bitcoin." However, Microsoft’s board dismissed the idea, citing Bitcoin’s volatility and the company’s commitment to “stable and predictable investments” for operational funding. Shareholders sided with the board showing their cautious stance on integrating cryptocurrencies into one of the world’s most valuable companies.

Similarly, Amazon has yet to embrace Bitcoin, despite receiving a proposal from the same center. The NCPPR urged Amazon to allocate 5% of its assets to Bitcoin, arguing that the cryptocurrency could serve as a safeguard against inflation and enhance long-term shareholder value. The proposal pointed to the growing adoption of Bitcoin ETFs and institutional interest as evidence of the asset’s maturity. However, Amazon’s leadership has not commented publicly on the proposal, and it remains unclear whether the company will take action.

This reluctance from tech giants like Microsoft and Amazon reflects a broader hesitancy among traditional corporations to integrate Bitcoin into their financial strategies. Unlike trailblazers such as MicroStrategy and Marathon, which view Bitcoin as a transformational asset, many companies are still grappling with its volatility and regulatory uncertainties. As Bitcoin continues to rise, the question remains: How long can companies like Microsoft and Amazon afford to sit on the sidelines while their competitors embrace the digital gold rush?

✍️ What Does This Mean for Bitcoin and the Crypto Market

The divide between Bitcoin buyers and skeptics represents a market at a turning point. Heavyweights like MicroStrategy, Marathon Digital, and ETF investors are cementing Bitcoin as a treasury asset, driving institutional adoption. Record-breaking ETF inflows, equivalent to 62 days’ worth of Bitcoin issuance in just five days, emphasize the insatiable growing demand.

In contrast, companies like Microsoft and Amazon remain hesitant citing volatility and regulatory uncertainty. While these concerns are valid, their reluctance may position them behind more forward-thinking competitors in the long run. This contrast shows Bitcoin’s dual identity as both a promising asset and a polarizing investment.

For the crypto market, institutional confidence is fueling the current rally. But, widespread adoption will require greater stability and regulatory clarity. As Bitcoin moves closer to mainstream acceptance, its trajectory appears to signal further growth—but its full potential hinges on converting skeptics into believers.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.