Sophia’s Thoughts On The Two Consecutive Sell-Offs

The crypto market has gone through two massive sell-off events that have pushed all coins down. Is this the new normal or is there a light on the horizon?

These are Sophia's Thoughts:

The first sell-off event was triggered on Friday after a stronger than expected US jobs report. It mostly impacted smaller altcoins.

The second sell-off started yesterday in anticipation of new US inflation data. It has affected all coins, including Bitcoin.

The new macroeconomic environment in the US makes it less likely that the Fed will cut rates anytime soon, which reduces investors’ appetite for risky assets like crypto.

We fear that more volatility will come out of these events as we learn more about what the Fed will do next.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

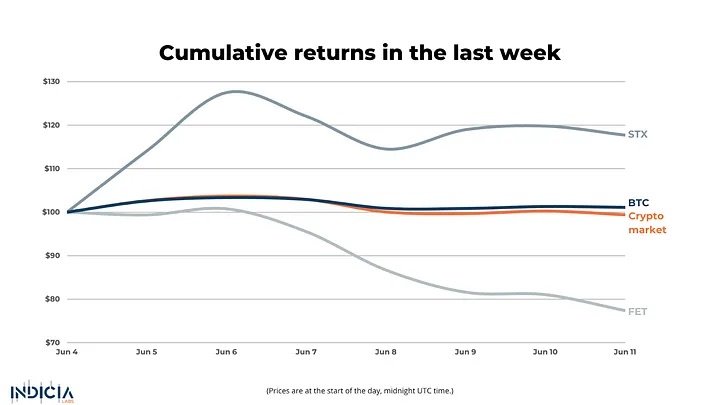

The crypto market lost 0.6% last week, while Bitcoin (BTC) gained 1.1%. Stacks (STX), a Bitcoin Layer for smart contracts, led the market gaining 17.7% this week. The worst performing coin of the week was Fetch.Ai (FET), which lost 22.6%.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🔻 The market sells off

The crypto market experienced a frantic sell-off. It all started on Friday with the release of the latest US labor report. The report showed that the US added more jobs than expected in May. It also showed an increase in wages. While the report indicated a simultaneous uptick in the unemployment rate, the market took the report to mean that the US economy is still running very hot. This is bad news for the crypto market because it suggests that the Fed may need to keep interest rates higher for longer. With high interest rates, safe assets like Treasuries appear more attractive than risky assets like crypto.

Investors did not react kindly to the news. Over the weekend, most altcoins saw significant declines. Ethereum (ETH), which had seen gains from the ETF news in previous week, struggled to maintain its momentum and ended the week 2.6% down. Solana (SOL) ended the week 3.6% down. And smaller altcoins below the top 20 coins saw average declines of 10% over the weekend.

Bitcoin (BTC) had remained mostly untouched over the weekend. But, just today, a new sell-off took hold of the crypto market, dragging all coins down. Bitcoin is now trading below USD 67,000 for the first time since May 20. The sell-off that began late on Monday and ensued today appears to be triggered by massive liquidation ahead of the new US inflation data that will be announced tomorrow.

Cryptocurrency prices on June 11: Bitcoin falls below $68K ahead of US CPI data (Economic Times)

Bitcoin (BTC) Price Dumps Below $68K in Minutes, Liquidating Over 75K Traders (CryptoPotato)

A massive day for the US economy is coming: What to watch (CNN)

🧮 The Fed’s Altered Calculation

The latest labor report has impacted the Federal Reserve’s considerations for future interest rate adjustments. Initially, there was speculation about potential rate cuts due to signs of economic slowdown. However, the unexpected strength in the jobs report has shifted expectations towards maintaining rates.

A month ago, there was a 25.4% chance of a rate cut by July. This has now dropped to 8.9%. Similarly, the likelihood of a rate cut by September has decreased from 61.2% to 48.9%. These changes suggest that the market now anticipates the Fed will keep rates higher for a longer period to soften the stubbornly strong economy in hopes of relieving inflation.

⏩ What’s to Come

Looking ahead, we anticipate increased volatility in the crypto market. The latest labor report has cast uncertainty over the Federal Reserve’s next moves regarding interest rates. This uncertainty is heightened by recent actions from other central banks, such as the European Central Bank (ECB) and the Bank of Canada, which have both recently cut their main interest rates. The ECB lowered its rate from 4% to 3.75%, while the Bank of Canada reduced its rate from 5% to 4.75%. These moves were aimed at stimulating their respective economies amidst ongoing inflation concerns and geopolitical risks.

Given the current low volatility environment, any unexpected economic data or shifts in policy could trigger market movements. Investors should be prepared for potential spikes in volatility because the underlying economic indicators point to possible turbulence ahead. The divergence between US and European monetary policies adds another layer of complexity, as differing interest rate paths could influence capital flows and market sentiment.

As we move forward, it is crucial for investors to stay informed and agile, ready to respond to rapid changes in the economic landscape. Monitoring the Fed’s communications and economic data releases will be key to navigating the coming weeks. The crypto market may experience significant swings as investors react to evolving expectations around interest rates and economic stability.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.