Sophia’s Thoughts On The Historically Low VIX

The VIX, known commonly as Wall Street’s fear gauge, is at historical lows. Does this represent a risk or an opportunity for crypto?

These are Sophia’s Thoughts:

The VIX is currently hovering at a value of 13, near the bottom 10th percentile of its historical distribution.

While a low VIX has in past instances foreshadowed periods of increased uncertainty, we are more confident that this is currently good news for crypto.

For one, a low VIX makes high risk assets look more appealing on a risk-reward basis. We find that this applies equally to crypto.

In addition, a low VIX is often accompanied by high consumer sentiment, which has historically benefitted crypto. So, we believe that a low VIX is currently good for crypto.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

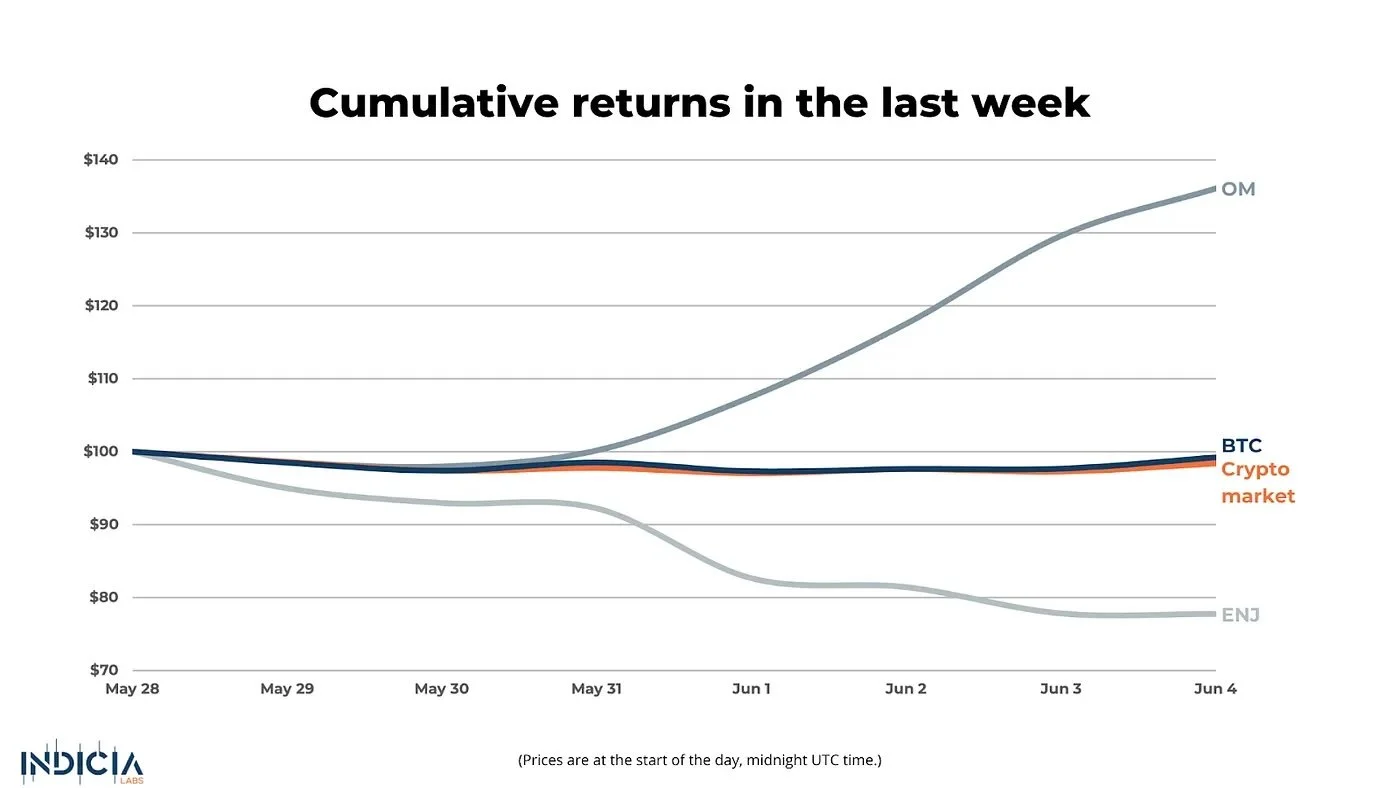

Last week, the crypto market lost 1.6% while Bitcoin (BTC) fell 0.8%. Mantra (OM), a real-world asset (RWA) blockchain that focuses on security, led the market gaining 36.1% this week after launching its RWA savings vault. The worst performing coin of the week was Enjin Coin (ENJ), which lost 22.1% after it was delisted from Coinbase.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📈 What is the VIX?

The VIX, also known as Wall Street’s “fear gauge,” measures market expectations for volatility as implied by S&P 500 option trades. A high VIX traditionally indicates increased market fear and expected turbulence, while a low VIX suggests investor confidence and market stability.

The VIX has historically spiked during periods of significant market uncertainty. For example, the 2020 pandemic led to the largest VIX rise in history, jumping to an all-time high value of 83 on March 16, 2020. But such high values are unusual. The VIX normally fluctuates around an average value of approximately 20. Sometimes it is higher, sometimes it is lower — the VIX is highly mean-reverting.

But something unusual has happened this year. Currently, the VIX is hovering around a value of 13. This low level may indicate a period of stability. As highlighted by Lombard Odier Investment Managers, a level of the VIX like we have now may be indicative of a soft landing in the US economy. It suggests that the US may be able to get out of an inflationary period without having to go through a recession. But the interpretation is difficult because a level of 13 is unusually low for the VIX. The bottom 10th percentile of the VIX over the last 5 years is 13.6.

So what does the low VIX imply for the crypto market? We took a deep-dive into the crypto economics implied by the current level of the VIX.

👍 Why A Low VIX Is Good For Crypto

We envision two channels through which a low level of the VIX may be good for crypto.

First, low levels of the VIX are generally good for high-risk assets. In previous instances in which the VIX has been low, investors have responded by taking on more risks. This has driven the prices of risky assets up compared to safe assets. For example, when the VIX was low in 2017, equities significantly outperformed bonds based on an analysis by T.Rowe Price. Furthermore, new research by professors from UCLA and the University of Rochester suggests that risky assets may have better return-to-volatility ratios (i.e., Sharpe Ratios) in low volatility environments precisely because of the lower levels of uncertainty.

We analyzed whether such results extend to the crypto market. Each month over the last 5 years, we considered a value-weighted average of the 100 largest coins in the crypto market and measured its monthly return. We then assessed whether this value-weighted crypto market index performed better or worse when the average VIX in the previous month was low vs high. Our results show that when the average VIX in the prior month lands in the bottom decile of its historical distribution, the crypto market generates high returns with low risk in the next month. This yields high Sharpe Ratios for the crypto market in low volatility environments.

Another mechanism that may drive better performance for cryptocurrencies in low VIX environments tightly linked to diversification. A low VIX often correlates with higher consumer confidence. For example, the VIX fell to a post-COVID low when investor confidence in the effectiveness of vaccines jumped up. A year ago, we observed a divergence in which the VIX was low and consumer sentiment was also low. But, towards the end of the year, consumer sentiment improved as inflation started to come down and the idea of a soft landing became more tangible. The VIX, on the other hand, remained low. All in all, low VIX and high consumer sentiment seem to go hand-in-hand.

As we highlighted in a previous Sophia’s Thoughts, the correlation between crypto and other asset classes tends to be low in periods of high investor confidence. This implies that investors stand more to gain through diversification by including crypto in their portfolios when investor confidence is high. The combination of a low VIX and high investor confidence makes crypto more attractive as an asset class. Professional investors appear to have noticed, pouring more than USD 15 billion into digital asset investment products year-to-date according to an analysis by CoinShares.

🧨 The Other Side

While a low VIX typically signals investor confidence and market stability, it can also suggest complacency and foreshadow increased volatility. Historically, significant economic or political events trigger spikes in the VIX after periods of calmness. For instance, the VIX surged dramatically during the European Debt Crisis, Brexit, and the COVID-19 pandemic. Currently, there are several concerning developments for the macroeconomy, including the widening war in the Middle East, the uncertainty about inflation globally, and the upcoming presidential election in the US. Still, the VIX remains unusually low. That may suggest that the market is underestimating aggregate risks.

However, new research by the Bank for International Settlements indicates that the current low VIX may have more to do with the way options traders are moving towards ultra-short-term maturity options and less with actual measurements of risk. And many professional investors are less concerned that the low VIX may foreshadow more uncertain times in the short run.

““Recent geopolitical events plus the Fed’s decision to maintain higher interest rates haven’t dented the market’s enthusiasm. There will certainly be more fluctuations in the VIX this year, but we would expect them to center on second half US elections and potential earnings weakness.” ”

All in one, we believe that the low levels of VIX are truly reflective of a period of calmness and increased investor confidence over the next few weeks. The positives seem to dominate the negatives for the crypto market. But while the current low VIX may be promising for crypto, investors should always exercise caution as market conditions can change rapidly.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.