Sophia’s Thoughts On the Spot Ethereum ETFs

The Spot Ethereum ETFs went live on Tuesday July 23rd and have brought in over USD 1 billion in inflows on the first trading day. Who are the main players and where might we go from here?

These are Sophia's Thoughts:

The U.S. SEC approved 9 Ethereum Spot ETFs on Monday July 22nd and they went live on Tuesday July 23rd.

Experts predict significant demand for these ETFs, expecting them to perform proportionally to the Spot Bitcoin ETFs that launched earlier this year.

On their first trading day, the Ethereum Spot ETFs generated over USD 1 billion in trading volume, with several issuers offering reduced trading fees to attract investors.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

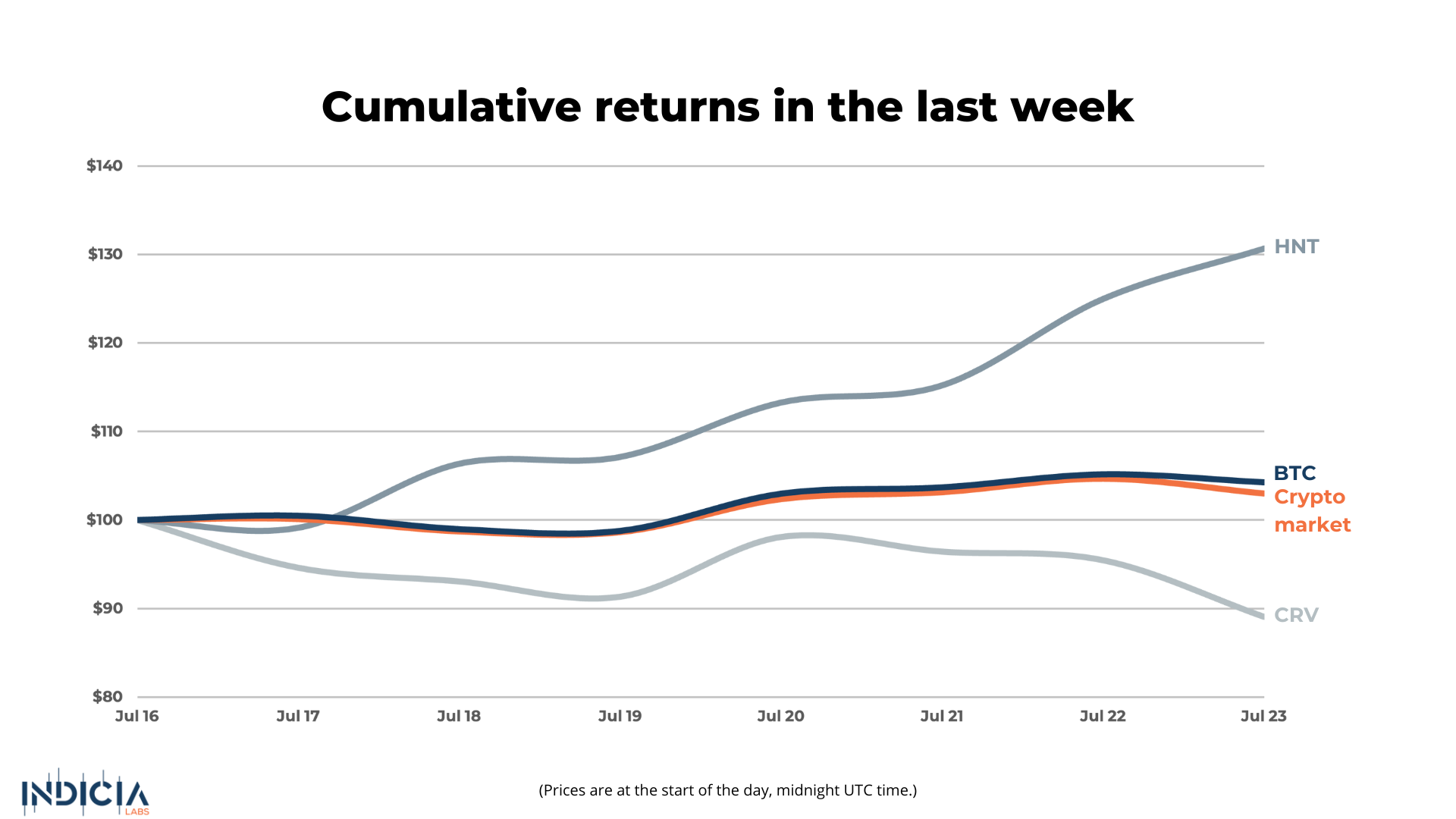

The market has ticked up slightly this week rising 3.0%. Bitcoin (BTC) outperformed the market gaining 4.2%. The worst performing coin was Curve DAO Token (CRV), which lost 11% over the week. The best performing coin of the was Helium (HNT), which gained 30.6% after reaching a significant milestone of 100,000 website users and 15,000 mobile hotspots deployed.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

⁉️ What are the Spot Ethereum ETFs?

The Ethereum Spot ETFs have received their final sign-off from the U.S. Securities and Exchange Commission (SEC) as of July 22nd. These exchange-traded funds (ETFs), which are set to begin trading on Tuesday July 23rd, will allow investors to gain direct exposure to Ethereum (ETH) through traditional financial markets. Ethereum is the second cryptocurrency asset, following Bitcoin, to have spot ETFs launched that provide direct exposure to its value.

Among the firms approved to launch these spot Ethereum ETFs are major financial players such as BlackRock, Fidelity, Grayscale, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy. This approval follows months of anticipation and regulatory discussions, culminating in the SEC's green light.

These ETFs will hold actual Ethereum, which will provide investors with a more straightforward and direct method of gaining exposure to the cryptocurrency. This direct holding mechanism is seen as an advantage for investors looking for a simpler and more direct way to invest in Ethereum, rather than self custody or via a crypto exchange.

The launch of these ETFs represents another major milestone for the crypto industry, reflecting growing acceptance and integration of cryptocurrency into traditional financial markets.

🏦 What are the experts saying?

Following the success of Bitcoin ETFs, which have brought in a record setting USD 17 billion since their launch, the Ethereum ETFs are expected to attract significant, albeit slightly lower, demand.

Eric Balchunas, a senior Bloomberg ETF analyst, noted, “Ethereum ETFs may attract lower demand than Bitcoin ETFs and may get 10 to 15% of the assets that bitcoin products received.” This translates to potential inflows of USD 5 to USD 8 billion in the initial years. Nate Geraci, president of The ETF Store, emphasized that the spot Ether market is less than a third of the size of the Bitcoin market, providing a reasonable expectation for Ethereum ETFs to capture a third of the demand seen with Bitcoin ETFs. Geraci stated, "The underlying spot ether market is less than a third of the size of the spot bitcoin market. I think that’s a reasonable proxy for what spot ether ETF demand will look like longer-term – about a third of the demand of spot bitcoin ETFs."

Geraci's assessment highlights the scalability and potential of Ethereum ETFs, even with a fraction of Bitcoin ETFs' interest. They are in a position to enhance Ethereum's liquidity, visibility, and market acceptance. Industry analysts, including James Seyffart of Bloomberg, are optimistic, viewing the approval as a significant step for Ethereum as an investable asset.

💸 Looking forward?

The initial trading day for Ethereum Spot ETFs has already proven to be a landmark event, with the nine different ETFs from eight issuers generating over USD 1.019 billion in cumulative trading volume. Leading the pack was the Grayscale Ethereum Trust (ETHE), which accounted for nearly half of the total volume at USD 456 million. BlackRock's iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) followed with USD 240 million and USD 136 million, respectively.

Many of these ETFs have introduced reduced trading fees to attract investors. For instance, Fidelity, 21Shares, Bitwise, Franklin Templeton, and VanEck have waived their fees until their products reach a certain amount in net assets. Grayscale Ethereum Mini Trust will waive fees for the first six months or until it reaches USD 2 billion in net assets, whichever comes first.

Analysts are closely watching the market to see how the Ethereum ETFs will compare to the success of the Bitcoin ETFs. While Ethereum ETFs are expected to capture a smaller share of the market compared to their Bitcoin counterparts, they still have the potential to pull in 20-25% of the assets, a target that Nate Geraci of The ETF Store believes is absolutely achievable.

As the Spot Ethereum ETFs continue to attract attention and investment, the next steps may include the incorporation of staking and options, pending SEC approval. These features could provide additional value to investors and further integrate Ethereum and blockchain technology into traditional financial markets. With a strong start and a promising path forward, the future looks bright for Ethereum and its growing ecosystem of financial products.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.