Sophia’s Thoughts on Solana’s Meteoric Rise

While everybody was focused on Bitcoin, the price of Solana doubled over the course of the last month. How exactly did that come about?

These are Sophia's Thoughts:

Solana gained 90% in 4 weeks, outshining Bitcoin and many other Layer 1 competitors.

This was accomplished by a series of successful improvements in its fundamentals. Solana now boasts a better test network, more developers, and more investments.

Investors have noticed and reacted positively. Sentiment for Solana has been very positive lately, much better than sentiment for Bitcoin and other coins.

All in one, Solana overcame the challenges that it faced after FTX, one of its earliest and largest backers, collapsed last year.

🚀 Last week’s market performance

Uptober gave way to Novembull as crypto continues its rally. The crypto market gained 4.6% while Bitcoin (BTC) gained 4.3% over the course of the last week. There were few losers last week, with BitTorrent (BTT) being one of the bigger ones. It lost 8.3% after a new feature release was poorly received by customers and followers. Unlike BitTorrent, PancakeSwap strongly benefitted from new feature releases, giving rise to an astonishing 91.5% price increase in the last 7 days. That made PancakeSwap (CAKE) the superstar of the week. And although almost doubling in a week is impressive, the price hike recovers only a part of the 62% loss that PancakeSwap had taken since the start of the year.

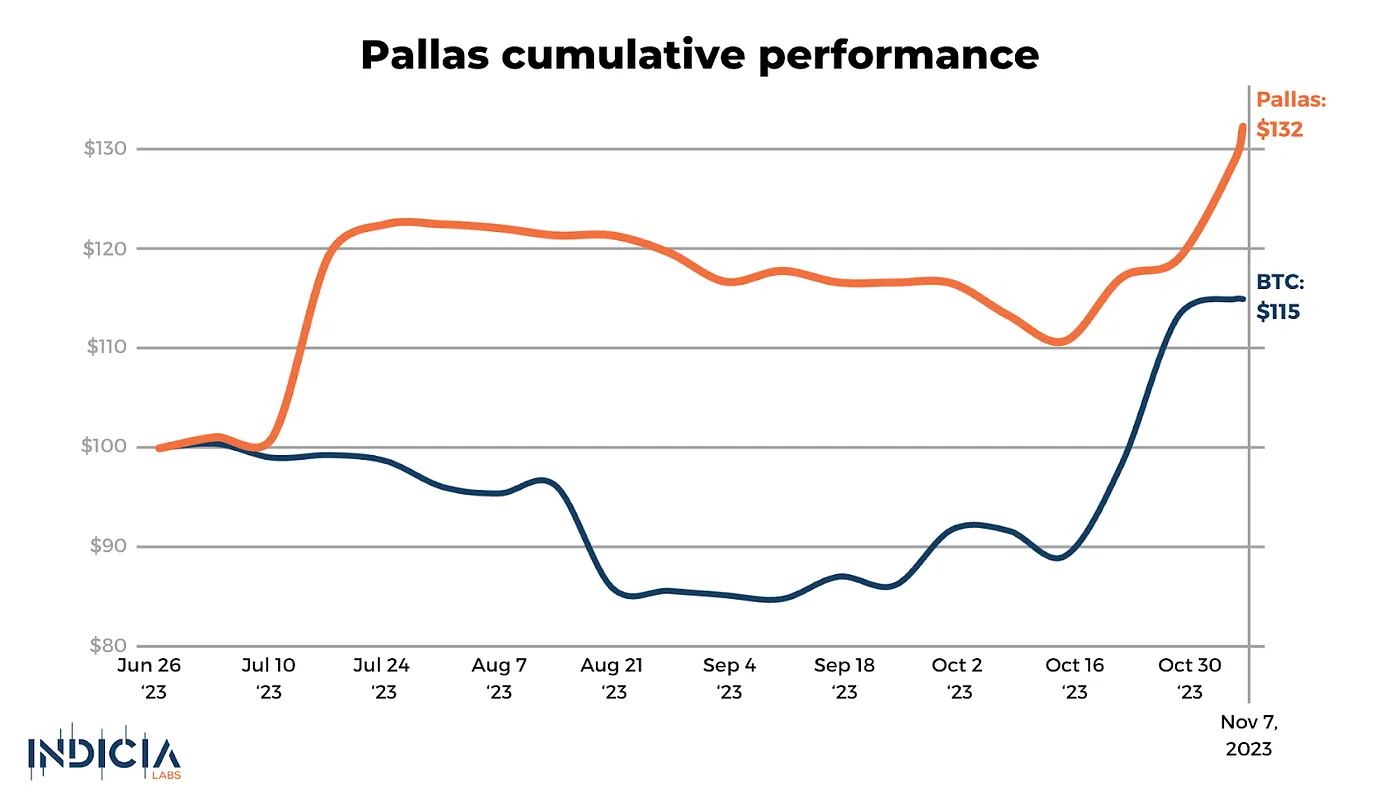

Sophia had steadily turned bullish over the last week, boosted by strong sentiment and improving fundamentals. This enabled Pallas, Indicia’s automated and openly accessible crypto trading solution, to generate 11% in profits over the last 7 days.

Are you interested in following Pallas and taking the profits? Then join IL Pro, Indicia Labs’s premium membership. Use the offer code SOPHIASTHOUGHTS to get a 3-month membership for free!

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📈 An astonishing rise

Solana (SOL) has experienced an impressive run over the last month. In just 4 weeks, the price of Solana went from USD 22 to USD 42 — a remarkable 90% increase. For comparison, the other Layer 1 coins that are viewed as peers of Solana, Cardano (ADA) and Ethereum (ETH), gained less than half of that amount. And Bitcoin (BTC) only gained 27% over the same time period.

Sophia had been initially bearish on Solana 4 weeks ago. Sophia’s mood for Solana started improving after October 17 when she perceived a strong boost for Solana’s valuation coming from social chatter sentiment. That week, Solana gained a first 33% in returns. Sophia’s mood for Solana weakened the following week when the sentiment boost seemed to slightly loosen up slightly. Then, last week, Sophia perceived both an improvement in fundamentals and sentiment, pushing her mood for Solana into bullish territory. Solana gained an additional 21% in returns since October 31.

Let’s dive deeper into the drivers of Solana’s meteoric growth.

📔 Fundamentals-driven growth

Solana has experienced several improvements in its fundamentals.

In a significant stride towards scalability and stability, Solana announced the launch of its much-anticipated Firedancer Testnet. Firedancer is a cutting-edge validator client designed to augment Solana’s network robustness by diversifying the technical pathways through which transactions are processed. Developed in collaboration with Jump Crypto, Firedancer promises to enhance the network’s throughput and resilience against outages. This strategic move not only addresses past network congestions but also sets a new standard in blockchain infrastructure’s capability to support large-scale, high-frequency transaction environments.

Solana gains 80% in a month as Firedancer goes live on testnet (Cointelegraph)

Solana soars 90% in a month as Firedancer testnet launches (Crypto.News)

Solana Records 80% Surge in One Month Amid Launch of Firedancer Testnet (The Tech Report)

Solana has also continued its upward trajectory in expanding the number of developers building apps on its network. Solana boasts 1,475 active developers and ranks as the fourth largest network by developer count. This reflects a notable rise in developer engagement, further evidenced by a 56% year-over-year increase in active development teams and a 59% growth in free tier teams on the Alchemy platform. The heightened activity underscores the platform’s robust and growing appeal to the developer community. A growing and healthy developer base is an important consideration for the valuation of cryptocurrencies.

In addition to thriving developers, Solana has also experienced large inflows of investments. Assets under management (AUM) tied to Solana investments grew by 74% in October and reached USD 140 million. This represents the steepest increase in AUM for any crypto-related investment class. AUM for Bitcoin investments grew only by 11% in October while Ethereum-based AUM declined by 5.45%.

💖 Strong support despite risks

A strong developer base combined with an inflow of capital means healthy fundamentals. And investors have noticed. Our intelligence indicates that Solana has experienced positive to very positive sentiment on social chatter in the last 4 weeks. Sentiment for Solana (and also the other Layer 1 coins Cardano and Ethereum) has remained strong in the last two weeks even as sentiment for Bitcoin has slightly stumbled.

The positive sentiment for Solana was not a given considering how it was affected by the FTX debacle. The collapse and bankruptcy of FTX deeply impacted the Solana DeFi ecosystem, with key assets becoming unbacked and collateral values plummeting by more than 50%. This was compounded by the fact that Solana lost half of its market value even before FTX’s bankruptcy. FTX was a major investor in Solana, holding approximately $1.16 billion in Solana tokens. This large stake meant that as FTX began to collapse, Solana saw sharp drops in value. The future of Solana became uncertain because FTX and Alameda Research, both significant backers of Solana, were embroiled in bankruptcy. This left Solana exposed to the highest sell pressure ratio on FTX, with a potential $3 billion liquidation looming over it. But Solana overcame the hurdles posed by the FTX collapse. And, now, it is one of the shining stars in the crypto landscape.

Join Indicia Labs for free to stay updated on the latest crypto developments. Use the offer code SophiasThoughts when you sign up for a 3-month membership.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.