Sophia’s Thoughts on Ripple’s Win

Ripple scored a partial win against the SEC when a judge ruled that Ripple is not always a security. What does this mean for the broader crypto market?

These are Sophia's Thoughts:

A US federal judge ruled that Ripple is only a security when tokens are sold in private placements to institutions. Ripple is not a security when traded on crypto exchanges, securing a major win for crypto.

Ripple, together with several coins that had previously been categorized as securities, boomed over the course of the week. The win triggered a new sentiment hype in crypto markets.

The ruling will have deep implications for crypto regulatory enforcement going forward. For one, Coinbase now has a precedent to argue that the SEC is unjustified in its actions against the crypto exchange.

The ruling is likely to ignite a new push for legislation on how crypto companies can operate. It may also settle the debate on whether coins are securities, giving crypto exchanges more freedom when it comes to what services they can offer.Join Indicia Labs for free now at www.indicia.io!

🚀 Last week’s market performance

Ripple (XRP) was the superstar of the week, generating more than 50% over the course of the week. Ripple’s win triggered a market boom of 5% on July 13. But almost all of those gains were lost in the later part of the week. The market ended up flat and Bitcoin (BTC) lost 1%. The biggest loser of the week was eCash (XEC). It experienced a correction after its 2x bull run in June.

For the first time again after two weeks, Sophia was bullish on coins last week. Sophia picked out the Ripple run ahead of time.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🎉 Ripple Wins

Ripple scored a win against the SEC on Thursday. A US federal judge ruled that XRP, Ripple’s native token, cannot be considered a security when individual investors buy and sell the token on public crypto exchanges. However, if XRP is transacted through private placements with institutional investors like hedge funds, then XRP is indeed a security. The judgment dealt a defeat to the Securities and Exchange Commission (SEC). Back in 2020, the SEC accused Ripple of selling $1.3 billion in unregistered securities when it offered XRP through both public sales to retail investors and private sales to institutions.

“There’s no way to look at the Ripple decision as anything but a win for the crypto industry”

The news caused a big market reaction even though the ruling was mixed in favor of Ripple. Let’s dissect what this ruling means for Ripple and crypto more broadly.

📖 The Howey Test

The judge’s decision was based on an established Supreme Court test called the Howey Test. The test answers the question whether a financial investment can be seen as security. If yes, the investment would be subject to strict securities regulation from the SEC. If not, the investment would be considered a commodity and face laxer regulation from the Commodity Futures Trading Commission (CFTC). In short, there is a higher threshold to offering securities for trading. It is not just Ripple who had an interest in learning how the judge would rule. Coinbase, Binance, Kraken, and many other crypto exchanges in the US were hoping that the judge would ultimately rule in Ripple’s favor.

The Howey Test requires that 4 criteria are met to categorize an investment as a security:

There is an investment of money.

The investment is made into a common enterprise.

The investor has an expectation that profits will be derived.

Profits are derived from the efforts of others.

In the ruling, the judge argued that how XRP was sold is what matters for whether or not it is a security. Ripple sold XRP to institutional investors assuring them that they would work to make XRP more valuable. All four criteria apply in such a setting and institutional sales of XRP are deemed securities. On the other hand, individual investors trading XRP on crypto exchanges did not know whether they were buying directly from Ripple. These trades were speculative so the last criterion could not apply as the profits that an investor expected could not be directly attributed to Ripple.

After the court decision was released, Ripple CEO Brad Garlinghouse spoke with Bloomberg and said that XRP is not a security in most cases.

🙋🏻♂️ What does this mean for crypto?

Ripple’s win is a milestone in this relatively new market. After the ruling was announced, the crypto market rallied with XRP gaining 66%. Ripple became the fourth largest digital asset by market cap.

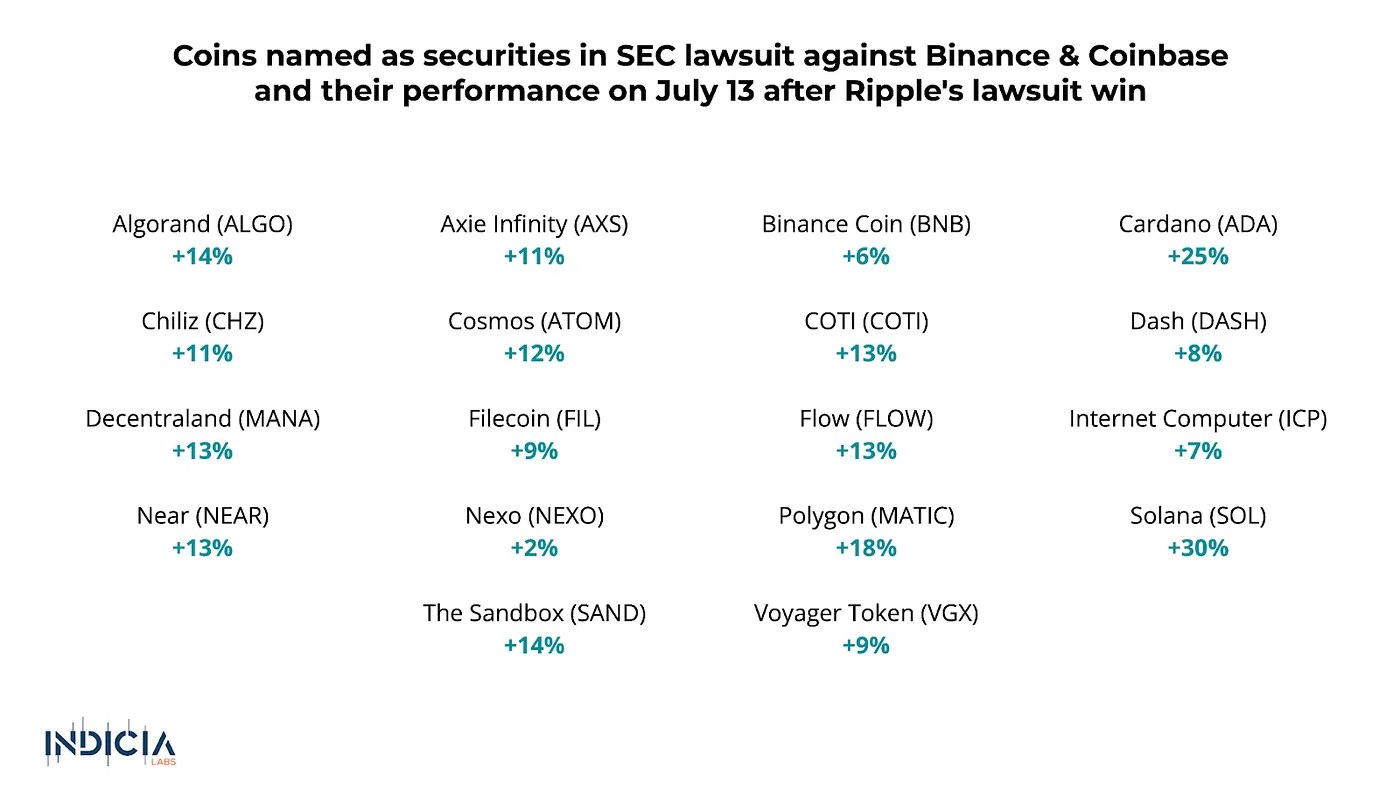

In past lawsuits, the SEC had mentioned that several other coins are also considered securities. These coins boomed after Ripple’s win. Cardano gained 25% while Solana gained 30% on the day the ruling was announced. The ruling is positive news for tokens as it eases up the requirements for institutions and exchanges to offer these digital assets. It makes it easier for investors to trade. Following the ruling, Coinbase and Kraken have relisted XRP on their exchanges.

The positive outcome for Ripple also boosted investor sentiment for crypto. The average sentiment that we measured across the largest 100 coins last week improved from neutral to positive right after the lawsuit outcome was announced. Sentiment has remained positive since then even though some of the Ripple-induced gains have been wiped by now. Cameron Winklevoss, one of the founders of the Gemini crypto exchange, said this was a “watershed moment” for crypto.

🎯 Impact on crypto regulation

If many tokens are not securities, then the SEC has no control over these assets. This opens up a void for new policies to be introduced on how crypto will be regulated going forward. Several lawmakers are now asking Congress to pass legislation that offers a framework in which crypto institutions and investors can operate. Senator Cynthia Lummis was happy about this decision and said that the ruling “confirms the need for Congress to deliver a clear regulatory structure for the crypto asset industry.”

Glenn Thompson, a Pennsylvania Republican who chairs the House Agriculture Committee, plans to introduce a bill introducing crypto legislation this week with the House Financial Services Committee Chairman Patrick McHenry.

In our previous articles Sophia’s Thoughts on the SEC Lawsuits and Sophia’s Thoughts on the Need for Regulation, we discuss the SEC lawsuits against Coinbase and Binance. In short, the SEC stated that these firms operated unregistered exchanges and argued that certain cryptocurrencies listed on their exchanges are securities. Given the recent landmark decision in the Ripple case, the SEC’s argument that the exchanges offered securities trading has lost significant footing.

“This is a significant opinion that has the potential to change the landscape of the SEC’s enforcement efforts, or the success of those efforts,”

But the ruling does not answer the question whether Binance and Coinbase operated unregistered brokerages. And, for Binance in particular, there are critical issues around the mismanagement of customer funds. In light of the Ripple lawsuit, we expect future regulation to be focused on how crypto exchanges can operate versus what coins exchanges can list.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.