Sophia’s Thoughts On The Recent Sell Pressures

The German government and Mt.Gox liquidations have created headwinds for the cryptocurrency market. Are there other forces at play or will this sell off be sustained?

These are Sophia's Thoughts:

The German government has recently begun selling off thousands of confiscated Bitcoin, causing sell pressure and raising questions about Bitcoin as a reserve currency.

Mt.Gox repayments have exacerbated the sell pressure as it has introduced nearly USD 3 billion onto various exchanges.

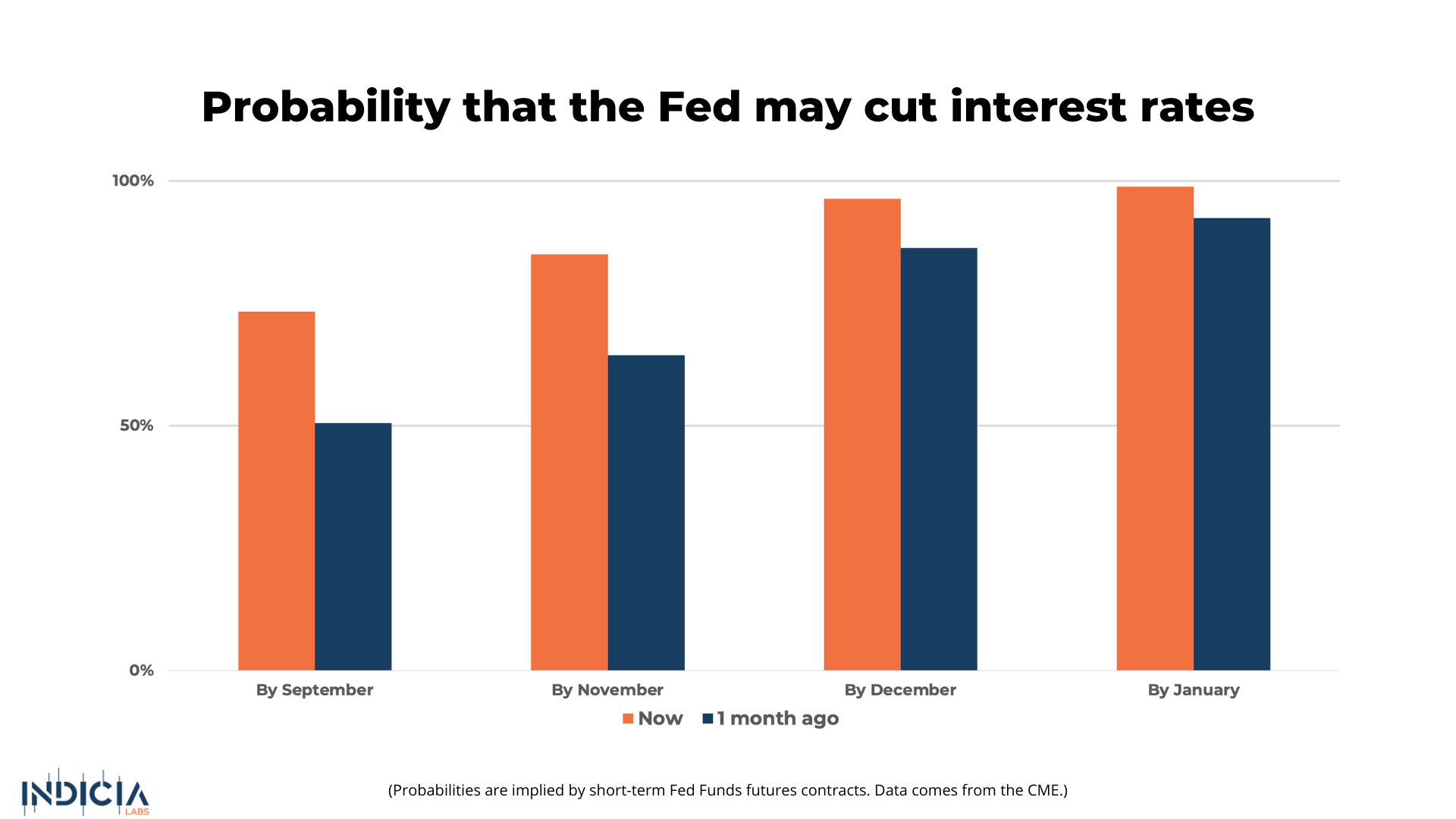

However, there is an increased probability of Federal Reserve rate cuts in September and net inflows into digital assets are turning around.

All in all, we are seeing positive signs on the horizon for the crypto market.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

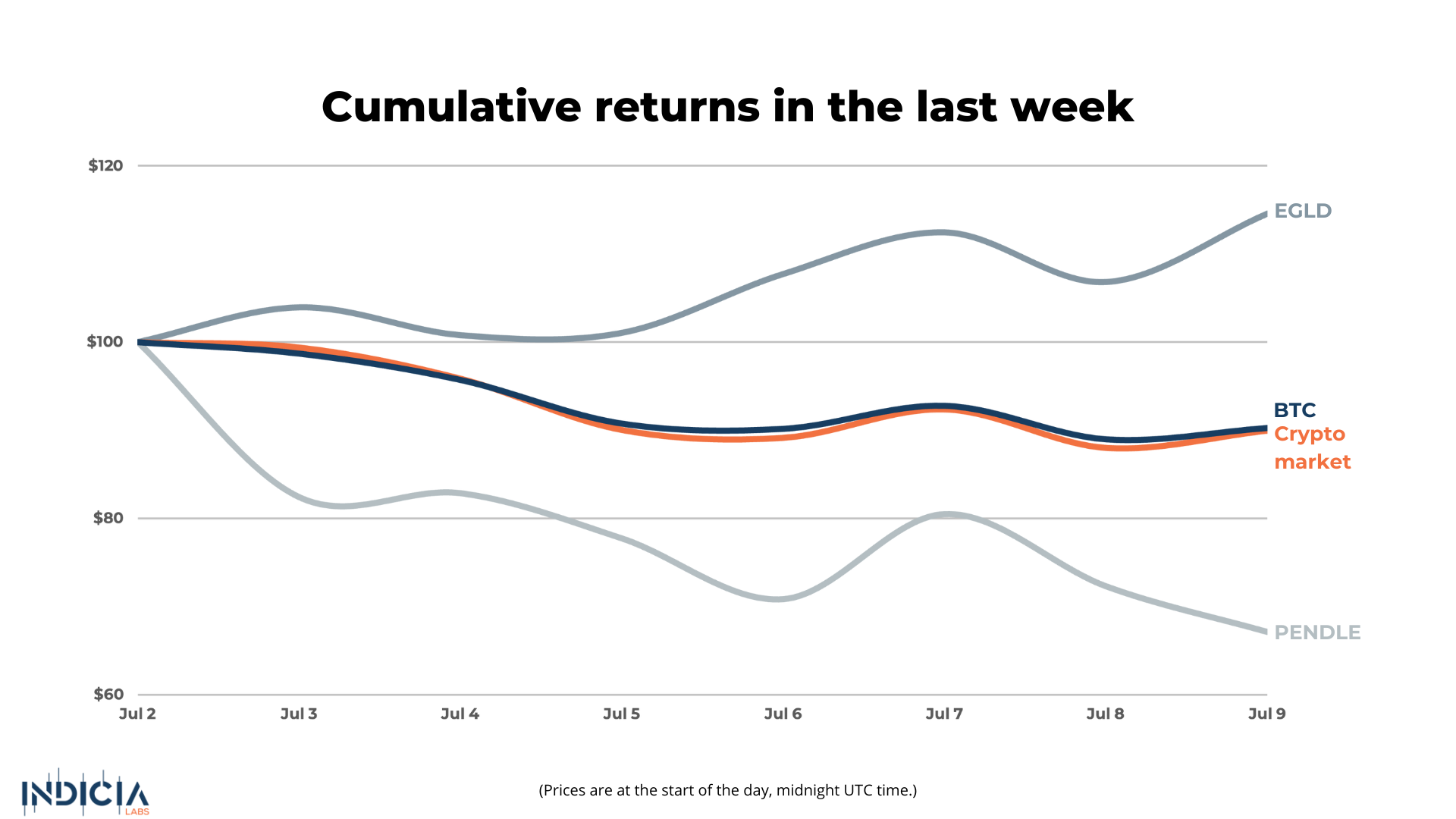

The market sold off by 10.1% this week amidst large sell pressures. Bitcoin (BTC) followed the market losing 9.7%. The worst performing coin of the week was Pendle (PENDLE), which lost 32.9% as whales moved large quantities of the tokens to exchanges to sell. The best performing coin of the week was MultiverX (EGLD), which gained 14.6% upon news of integration into the mobile and hardware wallet Safepal.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🇩🇪 German Government Sell-Off

In recent weeks, the German government has initiated a large-scale sell-off of Bitcoin. The Federal Criminal Police Office (Bundeskriminalamt or BKA) has been actively liquidating Bitcoin seized from criminal activities, including a major cache from the dismantled movie piracy site, Movie2k.to.

The sales began in June 2024. Initially, the BKA sold 900 Bitcoins, worth approximately USD 52 million at the time. This was followed by subsequent larger sales amounting to hundreds of millions of dollars. The total amount of Bitcoin sold by the German government has surpassed USD 390 million. The BKA has strategically transferred Bitcoin to various exchanges and market makers like Flow Traders, B2C2 Group, and Coinbase.

The German government’s approach to selling Bitcoin has not been without controversy. Joana Cotar, a member of the German Bundestag, the German National Parliament, has been a vocal critic. Cotar argues that the government should hold Bitcoin as a strategic reserve currency rather than selling it. She contends that such a strategy could provide long-term financial benefits for Germany's economy.

Joana Cotar expressed frustration over the government's lack of strategy. She told Forbes,"I can only speculate as to why the government is selling right now. As we have massive budget shortfalls in Germany at the moment, that could be one of the reasons." Cotar added, "I fear that the government has no strategy at all regarding how it wants to deal with bitcoin. We need to diversify our treasury and finally see and hold bitcoin as a strategic reserve currency." She further reflected, "It is really frustrating to have to watch politicians who have no idea about the matter squander a great opportunity."

Beyond Germany, several other governments hold significant amounts of Bitcoin. According to recent data, the United States leads with a substantial holding of 215,000 BTC, followed by China with 190,000 BTC. Additionally, other countries hold notable amounts.

⛰️ Mt.Gox Repayments

The Bitcoin market has also been under sell pressure stemming from the long-awaited repayments to creditors of the collapsed Mt. Gox exchange. Once the largest Bitcoin exchange globally, Mt. Gox filed for bankruptcy in 2014 after a series of hacks beginning in 2011 resulted in the loss of 850,000 BTC, which was worth approximately USD $450 million at the time. At its peak, Mt.Gox was handling around 70% of all Bitcoin transactions worldwide. A decade later, the process of repaying creditors has begun.

In July 2024, the trustee for the Mt. Gox bankruptcy estate announced that repayments to some creditors had commenced, introducing significant amounts of Bitcoin back into the market. According to Arkham Intelligence, over 47,000 BTC, valued at approximately $2.7 billion, were moved from Mt. Gox wallets to various exchanges in the initial phase of the repayments. The process is being facilitated through designated crypto exchanges such as Bitbank, SBI VC Trade, Kraken, Bitstamp, and BitGo, with varying timelines for distributing the funds to creditors, ranging from weeks to up to 90 days.

John Glover, Chief Investment Officer of Ledn, a crypto lending firm, noted,"Many will clearly cash out and enjoy the fact that having their assets stuck in the Mt. Gox bankruptcy was the best investment they ever made." This sentiment is echoed by other market observers who expect some creditors to sell their Bitcoin to lock in significant gains, given the cryptocurrency's dramatic price increase over the past decade. Despite these sell pressures, James Butterfill, head of research at CoinShares argues “that liquidity is sufficient to absorb these sales over the summer months," Butterfill told CNBC.

💸 Where To From Here?

The recent sell pressures from both the German government's Bitcoin liquidation and the repayments to Mt. Gox creditors have resulted in a significant sell off. Bitcoin has experienced a peak-to-trough decline of over 25%, marking one of the largest pullbacks in this cycle. Between Mt.Gox and the German government, tens of thousands of Bitcoins will be released into the market, creating significant downward pressure on price.

However, there is an additional force providing support for crypto prices. The probability of the Federal Reserve cutting interest rates by September has increased significantly. Based on Fed Funds derivatives data, there is now a 73.3% chance of rate cuts in September, up from around 50% just a month ago. A reduction in interest rates could provide a boost to the market, as lower rates generally encourage investment in riskier assets like cryptocurrencies.

Moreover, there has been a shift in market activity. After experiencing three consecutive weeks of net outflows, global digital asset investment products saw net inflows of $441 million last week, according to CoinShares. This turnaround may also provide a lift for crypto valuations.

Through Spot ETFs managed by firms such as Ark Invest, BlackRock and Grayscale, Bitcoin investment products accounted for the majority of these inflows, attracting USD 384 million. This is a bit lower than its usual dominance, indicating that investors are also diversifying into altcoin-based funds. Solana-based products were also successful, drawing $16 million in net inflows last week, partly driven by recent filings for a spot Solana ETF by VanEck and 21Shares. Additionally, Ethereum investment products saw a positive shift with $10 million in inflows. So, it is a mixed week with some developments dragging the market down while others continue to provide support.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.