Sophia’s Thoughts On The Recent Market Correction

Two new developments rattled the crypto market last week, triggering a sell-off that led to a 10% drop. What does this mean for the 2024 crypto bull run?

These are Sophia's Thoughts:

Early in the week, new inflation data from the US suggested that the Fed may not cut rates as quickly as many hoped.

Then, Iran retaliated against Israel in a new escalation in the war in the Middle East.

Both of these developments triggered anxiety among investors, leading to a withdrawal from risky asset classes. This had a direct effect on crypto.

Going forward, macroeconomic risks pose a challenge for the anticipated crypto bull run in 2024, which critically depends on a broader range of the population embracing crypto as an investable asset class.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🤨 What happened over the weekend?

This past weekend, the crypto market experienced a sharp decline. Bitcoin lost roughly 13% over the weekend, reflecting heightened market anxieties. Close to $240 million in Bitcoin futures positions were liquidated as a result. Among the biggest decliners of the weekend were AAVE, which saw a 25% decrease from start of Friday to end of Sunday, and altcoins like CAKE and 1INCH, which plummeted by 24% each.

The primary catalyst for this drop was the growing apprehension over potential military actions by Iran against Israel. Investor sentiment waned as the situation escalated. This led to substantial sell-offs. It followed an earlier decline mid week after inflation data in the US came out higher than expected. Overall, consumer sentiment, as measured in surveys by the University of Michigan, ticked down last week.

⚠️ How could a war in the Middle East impact crypto?

The possibility of an extended conflict in the Middle East raises significant concerns for the cryptocurrency market. Cryptocurrencies are often the first assets to be liquidated when investors become weary of macroeconomic shifts. The anticipation and onset of military actions contribute to such sentiment, which drives investors to safer assets. We witnessed a similar development when Russia invaded Ukraine back in February 2022. Bitcoin and Ethereum reacted as the conflict intensified and lost over 40% in the 6 months after the initial invasion.

We’ve noted in previous Sophia’s Thoughts how consumer sentiment directly influences crypto valuations. In times of geopolitical instability, the ensuing uncertainty can lead to decreased confidence in riskier investments like cryptocurrencies. This weekend’s events are a reminder that geopolitical tensions can swiftly alter market dynamics, potentially impacting bullish trends.

🏦 The continuous threat of inflation

Recent economic reports have not done much to soothe investor nerves. Last Wednesday, new data came out about inflation in the US. These data showed that inflation rose by 0.4% to an annual rate of 3.5% in March 2024. This uptick has led to widespread investor unease which was reflected in the volatility across broader financial markets, including cryptocurrencies. The Dow Jones and the S&P 500 shed over 1% upon the news on Wednesday.

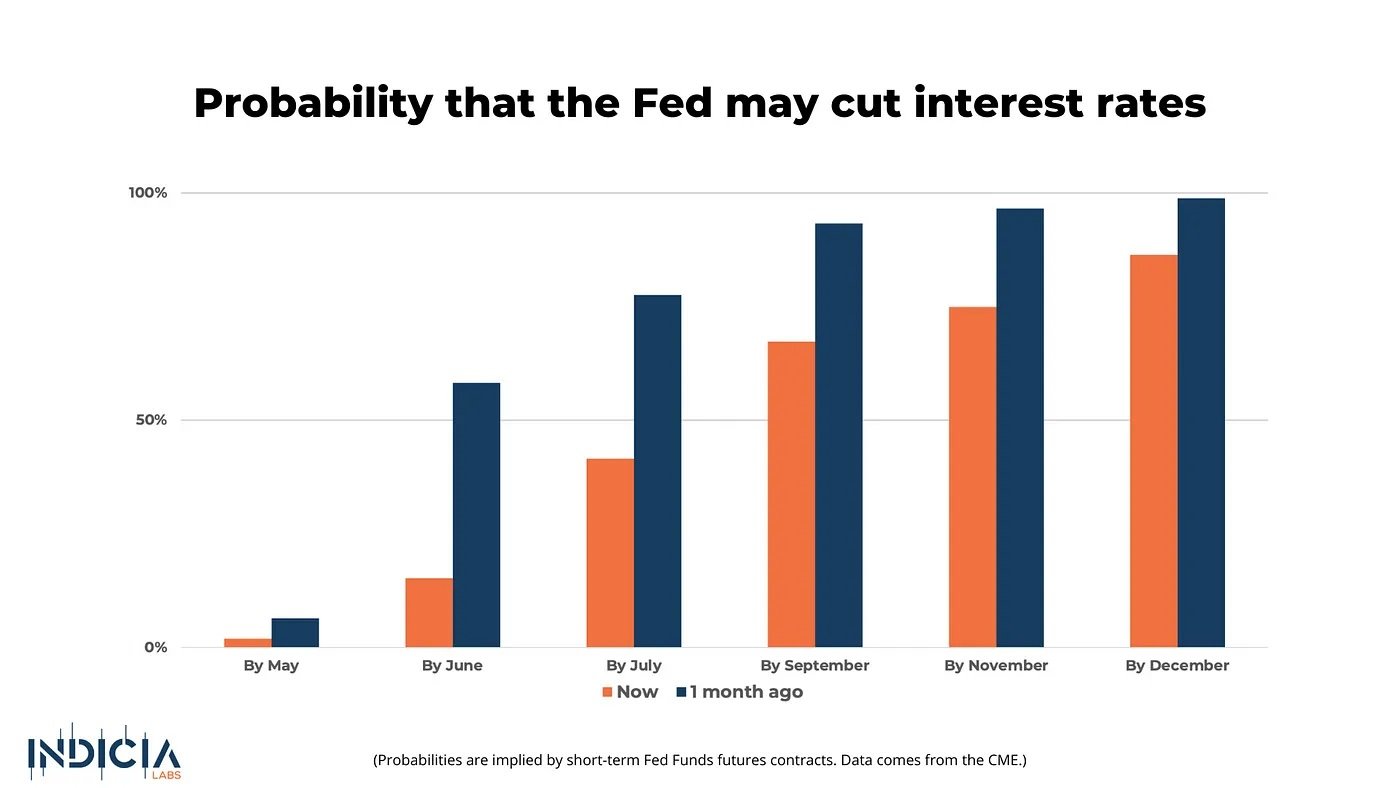

Previously, there was a wave of optimism that the Federal Reserve would implement rate cuts by mid-year to stimulate economic growth. However, persistently high inflation could postpone these cuts. Data from the CME suggest that investors are now less confident that the Fed will cut interest rates before September. This could deepen concerns among investors. Traditionally, high inflation coupled with the potential delay of monetary easing measures has led to a retreat from high-risk investments. Cryptocurrencies squarely fall into the high risk category.

The correlation between investor sentiment and crypto market performance underscores this trend. When traditional markets exhibit caution, it is common to observe a corresponding withdrawal from cryptocurrencies. Right now, investors appear to think that the Iran-Israel conflict may be somewhat contained. As a result, cryptocurrencies have bounced back a bit in the last couple of days. But we remain observant of how the situation develops as a potential bigger conflict in the Middle East poses a real macroeconomic threat to the crypto market.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.