Sophia’s Thoughts on The Rise of Real-World Asset Tokenization

BlackRock and Franklin Templeton’s venture into tokenization are the beginning of a new era in finance. Why does tokenization matter? And what obstacles stand in the way?

These are Sophia's Thoughts:

BlackRock and Franklin Templeton just stepped into the world of tokenized funds, signaling mainstream adoption of Real-World Asset (RWA) tokens.

The rise of tokenization is further propelled by breakthroughs in blockchain projects like Avalanche and Chainlink, alongside pivotal regulatory frameworks like MiCA in Europe.

Amidst the surge in RWA tokens, debates on their classification as securities or commodities highlight the evolving regulatory and market landscape.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

The crypto market and Bitcoin (BTC) both flatlined last week, losing between 0.3 and 0.7%. One of the biggest winners of this week is Pendle (PENDLE). Just like last week, Pendle continued its impressive growth, gaining another 33% and doubling over the course of the last two weeks. All of this is fueled by the hype about tokenization, which Pendle is a central element of with its tokenized yield protocol. The biggest loser of the week is Akash Network (AKT), which lost 24%.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🌍 The venture into tokenization

BlackRock took an innovative step in the digital asset space with BUIDL, its first tokenized fund. And it marks a shift in the asset management industry.

BUIDL was launched last month. Operating on the Ethereum network, BUIDL tokenizes financial assets, where each digital token symbolizes a share of ownership in the fund. The fund primarily invests in the U.S. Treasury bills and comparable assets, targeting a stable value proposition of approximately $1 per token. This aligns with traditional expectations of asset-backed securities.

Why is BlackRock doing this now? The giant asset management company advocates for tokenization as a pathway to democratized access, aiming to lower entry barriers for investors. The fund promotes expedited settlement times, diverging from the conventional lags in asset transfer and validation. Transparency is another cornerstone, as blockchain technology offers an immutable record of transactions, enhancing investor trust and fund governance.

A similar fund was recently launched by Franklin Templeton. The Franklin OnChain U.S. Government Money Fund (FOBXX) invests in U.S. Treasury securities as well as collateralized repurchase agreements. FOBXX broke new ground by being the first U.S. registered fund to use a public blockchain, Stellar (XLM), to record share ownership and transaction activity.

BlackRock and Franklin Templeton’s tokenized funds are more than new products. They are testaments to the companies’ commitment to embracing and shaping the future of digital assets. They showcase a vision where blockchain’s potential is harnessed to enhance the foundational aspects of investing — accessibility, speed, and transparency.

💼 Why tokenization matters

The tokenization of real world assets is taking a central stage in the crypto market these days. The allure of real-word asset tokens — or RWAs as they are known in short — lies in their ability to democratize access to investment opportunities. Some of the benefits that the tokenization of real world assets promises include:

Fractional Ownership: RWA tokens break down barriers to entry for investing in high-value assets, enabling fractional ownership and opening new avenues for a broader investor base. Historically, investing in high-value assets like real estate or paintings was limited to extremely wealthy individuals. RWAT’s break this barrier by enabling fractional ownership.

Market Liquidity: The blockchain enables RWA tokens to be traded 24/7, enhancing liquidity and transforming assets traditionally considered illiquid. Traditional assets often have limited trading windows and restricted access. Stocks, for example, can only be traded during exchange hours. RWAs can be traded around the clock on global marketplaces, providing investors with flexibility.

Operational Efficiency: The inherent transparency and security of blockchain technology streamline transactions, reduce overhead costs, and provide a tamper-proof record of ownership. Transactions are recorded on a secure and transparent ledger, eliminating the need for intermediaries like brokers and custodians. This reduces paperwork, lowers overhead, and speeds up settlement times. Additionally, blockchain technology is tamper-proof and ensures a secure and reliable record of ownership.

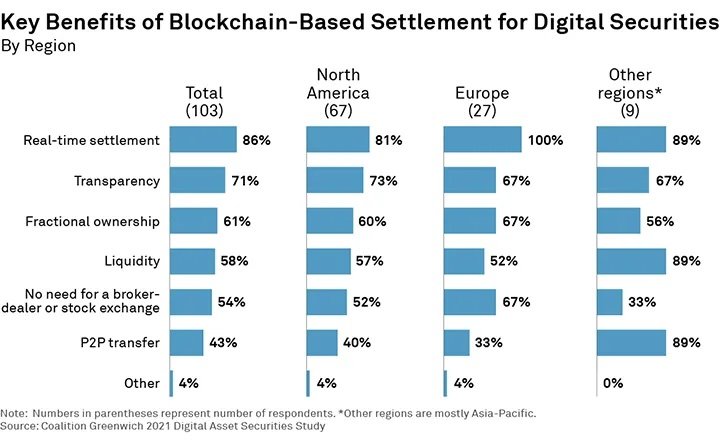

These benefits were also highlighted in a 2021 survey by Arca Labs and Coalition Greenwich, who interviewed international market participants in front offices, technology, risk, operations, strategy and management roles to understand the perception of digital asset securities and the potential for tokenization.

🚀 The rising stars of tokenization

A few standout crypto projects are reshaping how we interact with tokenization technology.

Avalanche (AVAX) is breaking new ground, facilitating the creation of decentralized applications with a focus on scalability and robust transaction capabilities. This makes it a go-to for businesses looking to tokenize real-world assets.

Chainlink (LINK) serves as the linchpin of RWA tokens by securely connecting blockchains with verified external data. It is essential for maintaining the integrity and reliability of tokenized assets.

Internet Computer Protocol (ICP) is expanding the possibilities by aiming to host internet services on the blockchain, which could revolutionize RWA token management and trading.

Maker (MKR), integral to the MakerDAO and the DAI stablecoin system, plays a critical role in the DeFi ecosystem, potentially pairing with RWATs to offer stable investment channels.

Stellar Lumens (XLM), is an open-source, decentralized protocol for digital currency to fiat money low-cost transfers which allows cross-border transactions between any pair of currencies.

Another important new development are Security Token Offerings (STOs), which are becoming game-changers. STOs allow real-world assets, like company shares or property, to be represented as digital tokens on a blockchain, providing a twist to traditional investing. These differ from NFTs that offer unique ownership of digital assets. They utilize blockchain technology to create digital securities that align with securities regulations. These digital tokens can reflect ownership of part of a building, a piece of art, or a slice of a company, just like stocks or bonds.

Then, in March, we witnessed the tokenization of more than $1 billion in US Treasuries, a ten-fold increase since January 2023. These government bonds have been transformed into digital tokens on public blockchains such as Ethereum, Polygon, Avalanche, and Stellar. It is a significant step that shows the potential for RWA tokens to include a wide array of assets, paving the way for a future where many more such investments could be tokenized and traded with ease.

🔍 The regulatory landscape

Regulation on real-world asset tokenization in the US is confusing. A big part of the confusion centers around the never-ending discussion of whether tokens are securities or commodities. Depending on how the RWA token is set up, it seems like it would either fall under security or commodity regulation. This is illustrated best by Propy CEO Natalia Karayaneva. Propy is a leader in the tokenization of real estate assets.

The classification of real-world asset tokens as either securities or commodities carries large implications for their regulatory treatment, taxation, and market behavior. Firstly, being classified as securities would subject RWAs to stringent SEC regulations, affecting their issuance, trading, and transparency requirements. Secondly, the tax implications differ significantly. Securities face capital gains taxes based on holding periods, whereas commodities might benefit from more favorable treatments. Lastly, this classification influences market access and liquidity, with securities facing potential restrictions on trade venues and investor eligibility, while commodities could enjoy broader trading platforms and less restrictive participation criteria.

The regulation in other places is much more advanced. The European Union is preparing for the 2024 introduction of the Markets in Crypto-Assets (MiCA) regulation. MiCA is designed to lay a regulatory foundation, clarifying the legal status of crypto-assets and, notably, security tokens that represent real-world assets like property or art. With its focus on registration, operational standards, and consumer protection, MiCA is set to boost investor confidence and innovation. The framework is poised to accelerate the adoption of tokenization, unlocking new investment opportunities across Europe and cementing the legitimacy of Real World Asset Tokens (RWATs) within the EU’s financial landscape.

While regulation in the US is missing, industry proposals are shaping the conversation. New protocols like ERC-3643 have been introduced to make sure that tokenized assets are compliant, offering investors the confidence to enter this emerging market.

The journey into real-world asset tokenization is a new chapter in finance, characterized by inclusivity, liquidity, and efficiency. As institutions like BlackRock venture into tokenization, the future of RWA tokens shines brightly. However, as with any new venture, navigating the complexities of regulation and market integration will be key to unlocking the full potential of RWA tokens.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.