Sophia’s Thoughts On The Crash After The ETFs

The approval of spot Bitcoin ETFs was highly anticipated and hyped. But, when the ETFs actually got approved, the crypto market tanked. Why did this occur?

These are Sophia's Thoughts:

Leading up to the approval of spot Bitcoin ETFs by the SEC in the United States, the crypto market rallied and gained more than 24% in just a month.

But, as soon as the ETFs got approved, the crypto market retracted. Bitcoin fell by as much as 20% from its peak right after the ETFs got approved.

While many conjectured a sell-the-news effect, we think that the crash was less due to investors optimally timing the market and taking gains and more due to short-term adjustments in the market for spot Bitcoin ETF shares.

Our intelligence suggests that we have now reached the bottom and that fair fundamentals combined with positive sentiment will provide a lift for crypto valuations going forward.

Our AI + Your Sentiment = Exceptional Crypto Performance. Join Indicia Labs now to follow Pallas and start performing like a crypto hedge fund. Try us out for free for one months using the offer code SophiasThoughts.

🚀 Last week’s market performance

The crypto market gained 7.3% last week while Bitcoin (BTC) gained 9.4%. The worst performing coin of the week was Siacoin (SC). It lost -28.5%, correcting a prior run from early in January. The best performing coin of the week was Huobi Token (HT), which gained 53.6%.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🔻 An Unexpected Crash

For weeks, investors anticipated that the SEC may finally approve spot Bitcoin ETFs. After the SEC faced several legal failures fighting spot Bitcoin ETFs in court, the approval seemed inevitable by the January due date for a final decision on Ark Invest’s application. And, so, the SEC approved all outstanding spot Bitcoin ETF applications on January 10, 2024. The ETFs started trading on January 11, 2024.

The anticipated move by the SEC had already led to a massive surge in crypto valuations prior to the actual approval of spot Bitcoin ETFs. Between December 1 and January 10, the price of Bitcoin (BTC) surged by 24%. But as soon as the ETFs started trading on January 11, the price of Bitcoin fell from its peak of close to USD 49,000 to as low as USD 38,500 on January 23. That represents a decline of 21% within just a few days.

The crash was not constrained to just Bitcoin. The broader crypto market closely followed Bitcoin but ended up losing slightly less since its peak a day after the spot Bitcoin ETFs got approved. Why did this crash occur? Let’s dig in.

🗞️ Sell The News? Or GBTC sell-off?

Prior to the approval of the spot Bitcoin ETFs, there was some talk about a possible “sell-the-news” effect. The sell-the-news effect is a market phenomenon where the price of an asset falls following the release of positive news or a highly anticipated event. This occurs as the event or news often leads to speculative buying, increasing the asset’s price ahead of time. However, once the event happens or the news is released, it can trigger widespread profit-taking as the event is already factored into the price. This results in a price decline, reflecting a shift in market sentiment and a lack of new growth catalysts.

Many speculated that the decline after the approval of spot Bitcoin ETFs was due to a sell-the-news effect. On-chain analytics firm CryptoQuant expressed concerns that the expected approval of spot Bitcoin ETFs would trigger a sell-the-news effect. Similarly, analysts at 10X Research forecasted a decline in the price of Bitcoin to USD 38,000 in the short run. The crash we have experienced in the last few weeks is consistent with a sell-the-news effect.

However, we are not convinced that sell-the-news is the whole story. Sell-offs at the Grayscale Bitcoin Trust (GBTC) also played a pivotal role. Following its conversion to an ETF, GBTC sold off more than USD 5 billion in BTC. This sell-off was driven by various factors, including profit-taking by investors who had bought in at a discount and a shift to other spot Bitcoin ETFs offering lower fees. Grayscale’s fee of 1.5% was higher compared to its competitors, which charged fees ranging from 0.2% to 0.9%. This disparity in fees likely triggered a migration of capital from GBTC to other ETFs: while GBTC saw outflows of USD 4.3 billion, BlackRock’s iShares Bitcoin Trust (IBIT) attracted $1.82 billion.

Then there was also FTX. Following Grayscale’s conversion into an ETF, the failed exchange FTX was able to sell around 22 million shares of GBTC for a value of close to $1 billion out of bankruptcy court. All in one, GBTC got hit hard for reasons unrelated to Bitcoin. While the sell-offs at Grayscale contributed to the recent crypto crash, the GBTC developments provide little support for the sell-the-news narrative.

🧠 Sophia’s Insights

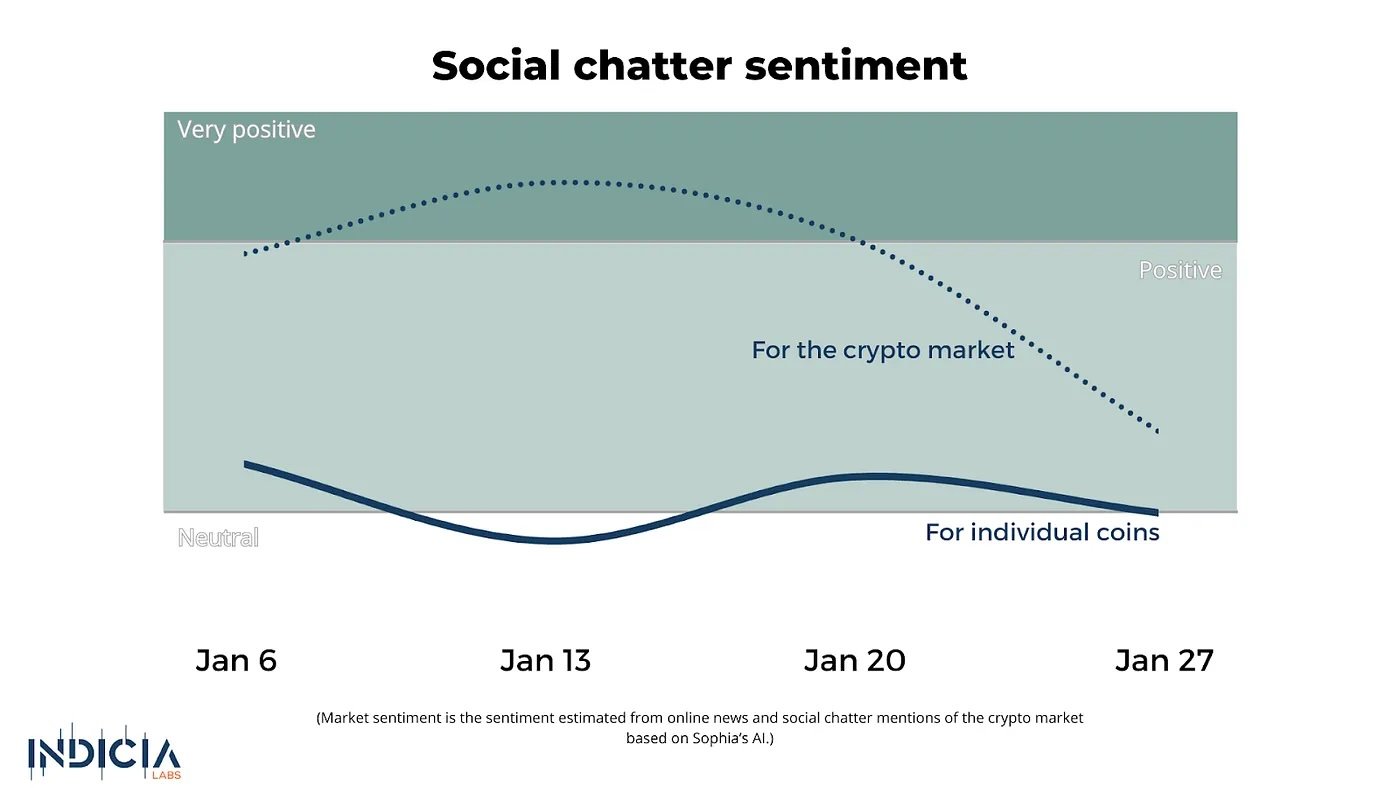

Sophia was neutral on coins ahead of the approval of the spot Bitcoin ETFs. Once the spot ETFs got approved, Sophia became more bullish. Sophia remained bullish until early last week and then became neutral again.

At the same time, Sophia started measuring a weakening of fundamentals. Right after the ETFs got approved, Sophia’s estimate of the valuation boost provided by coin fundamentals turned negative. Sophia also measured a weakening of social chatter sentiment. In our last sentiment update, we reported that crypto sentiment on social chatter had turned positive after having been very positive for a couple of weeks. The weakening of sentiment dampened crypto valuations. Sophia’s estimates of the valuation boost provided by social chatter sentiment turned neutral two weeks ago.

Last week, Sophia started measuring an improvement in crypto valuations relative to fundamentals and social chatter. The combination of uplifting sentiment combined with fair fundamentals is making Sophia more optimistic. Sophia’s Coin Mood has ticked up in the last two days.

🚦 The Road Ahead

In the past when Sophia measured similar coin mood and valuation boosters as right now, an average coin in the market proceeded to gain 0.4% over the course of the following 7 days. That’s not a very large return considering that the weekly volatility of the crypto market is close to 10%. But it is potentially an indication that the down cycle post spot Bitcoin ETF approval may be coming to an end. This is an opinion that is also share by several experts:

Grayscale’s GBTC Profit Taking Likely Over, Easing Bitcoin Selling Pressure: JPMorgan (CoinDesk)

Why Did FTX Dump Most of its GBTC? Over 75% Has Gone. (BeInCrypto)

In the short run, the developments surrounding the spot Bitcoin ETFs will continue to dominate the crypto market. But another topic will soon become more relevant: the upcoming Bitcoin halving. This is expected to occur in April. And it might bring a renewed push for crypto prices. More on that in our upcoming Sophia’s Thoughts.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.