Sophia’s Thoughts On Breaking All-Time Highs

Bitcoin crossed its all-time high and many altcoins are establishing new records. Is the rally over now or are we just getting started?

These are Sophia’s Thoughts:

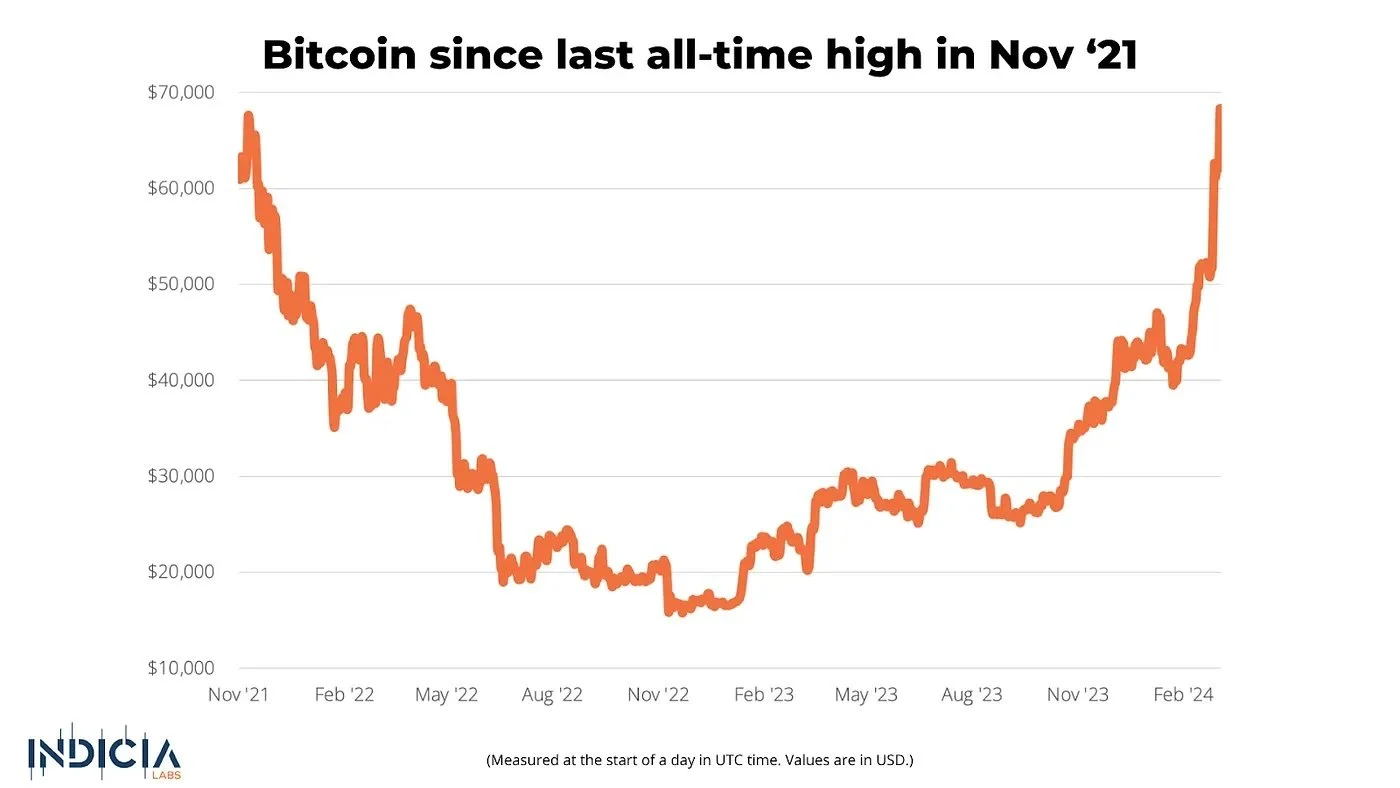

Bitcoin established a new all-time high above USD 69,200, beating its previous high from November 2021.

Many altcoins have also seen record valuations, boosted by strong sentiment and improving fundamentals.

Sophia has remained neutral or bullish on cryptocurrencies, showcasing a recent accuracy rate of 60%.

We anticipate the rally to endure even after today’s correction, in part due to the Bitcoin halving and the possible approval of Ethereum ETFs that may provide new fuel for the crypto market.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

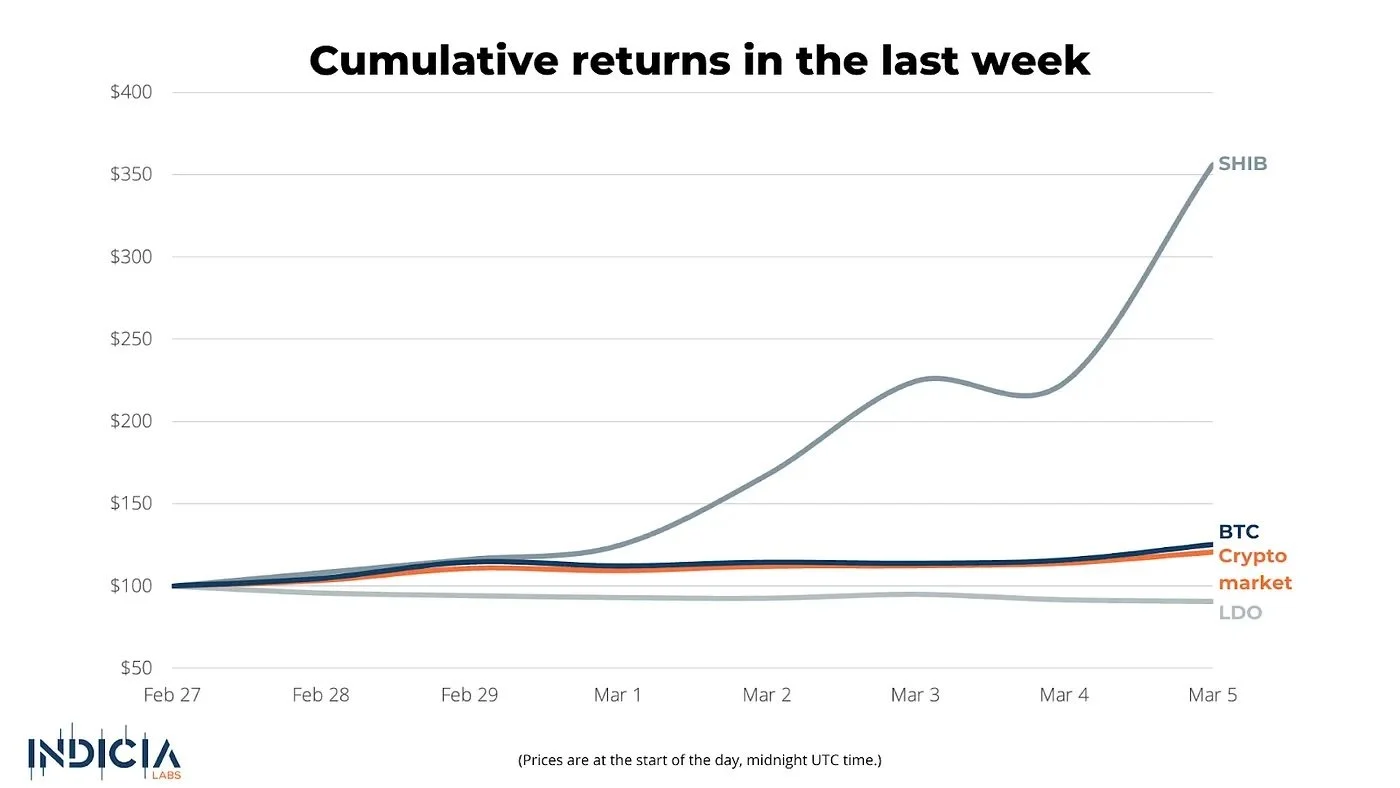

Bitcoin (BTC) gained 25% last week while the crypto market only gained 21%. The best performing coin was Shiba Inu Coin (SHIB). It more than tripled in value in the last 7 days. Sophia had been bullish on SHIB repeatedly in the past, driven by what we perceived to be very strong sentiment. The worst performing coin of the week was Lido DAO (LDO). It lost 9.4% amidst controversy about a new staking proposal.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

💸 Bitcoin breaks through

Last week, we wrote that Bitcoin was only USD 12,000 away from its all-time high. That’s no longer true this week. Bitcoin (BTC) has broken its all-time high against the US Dollar. On Tuesday, March 5, Bitcoin traded above USD 69,200, establishing a new USD all-time price record.

And it’s not only against the USD that Bitcoin has established a new record. Bitcoin has rallied globally and hit new all-time highs against at least 30+ global currencies, including the Australian Dollar and the Euro.

In spite of the excitement, Bitcoin immediately retracted after hitting the new all-time high. As of the time of writing this article, Bitcoin was trading below USD 63,500. That’s almost 10% below the new all-time high. Still, a correction after establishing a new record was expected as investors are happily taking their gains.

Crypto Traders Hedge Bitcoin Rally After 40% Rise in 4 Weeks, Options Data Show (CoinDesk)

Bitcoin to Correct Ahead of New Record, Crypto Bull Mike Novogratz Says (Business Insider)

Is BTC on the Verge of Exploding Beyond $69K ATH or is a Correction Imminent? (CryptoPotato)

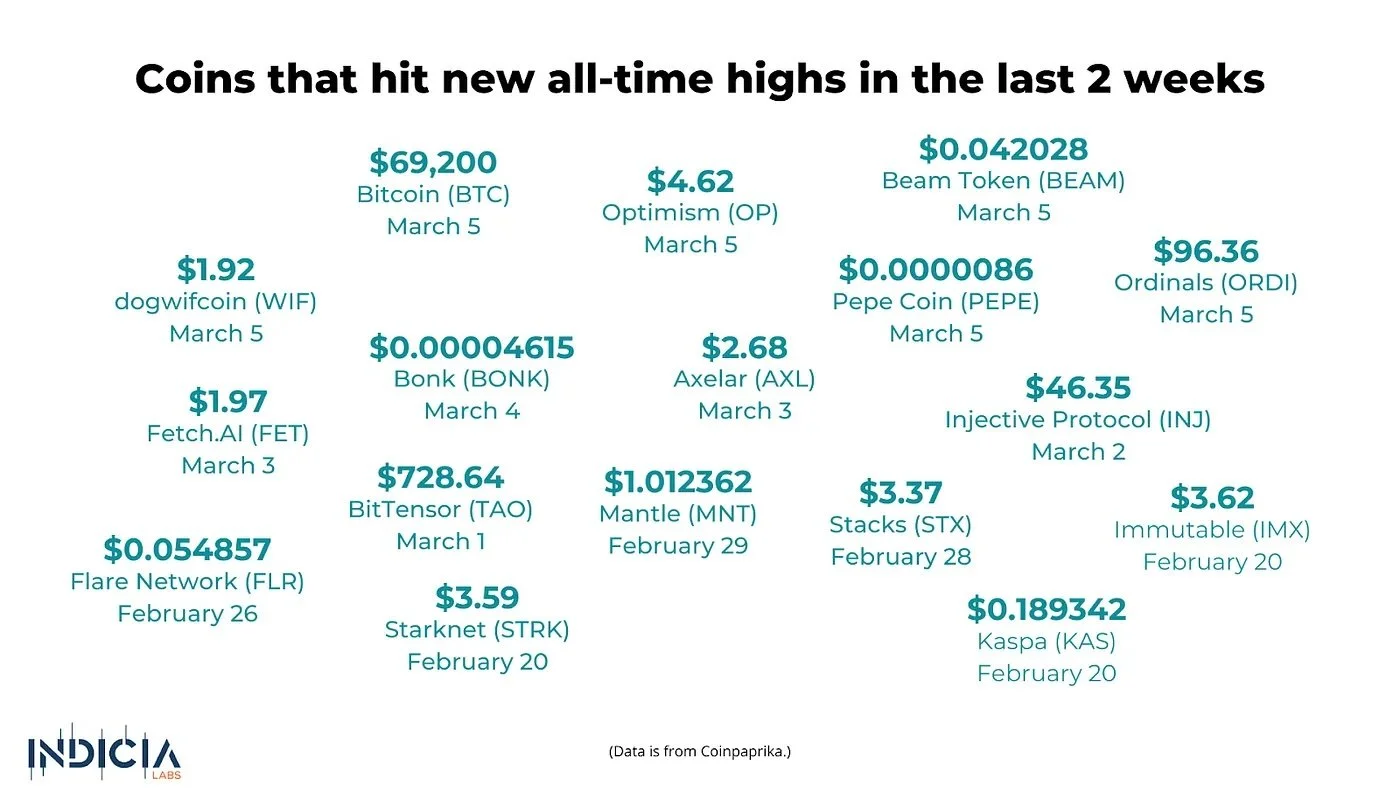

📈 Altcoins are also rallying

It’s not just Bitcoin that is rallying. Several altcoins have also broken their all-time highs and established new records. Some coins are rallying due to strong fundamentals. A good example is Stacks (STX), a platform that enables decentralized apps and smart contracts on the Bitcoin network. It has heavily profited from the hype around Bitcoin. On a scale in which -100% means that fundamentals are hurting the valuation of STX while +100% means that fundamentals are boosting the valuation of STX, Sophia ranks STX at +43%.

Other coins are benefiting from the improvement in sentiment for cryptocurrencies. Crypto sentiment, as expressed in online news and social chatter, has been turning more and more positive in recent weeks. And this is providing a lift for cryptocurrency valuations. A prime example: Immutable X (IMX), a platform for NFTs and blockchain gaming on the Ethereum network. Sophia has a neutral assessment of IMX’s fundamentals. But, when assessing how strongly sentiment is uplifting the valuation of IMX on a scale from -100% to +100%, Sophia grants IMX a positive score of 51%.

🙋🏻♂️ Where to now?

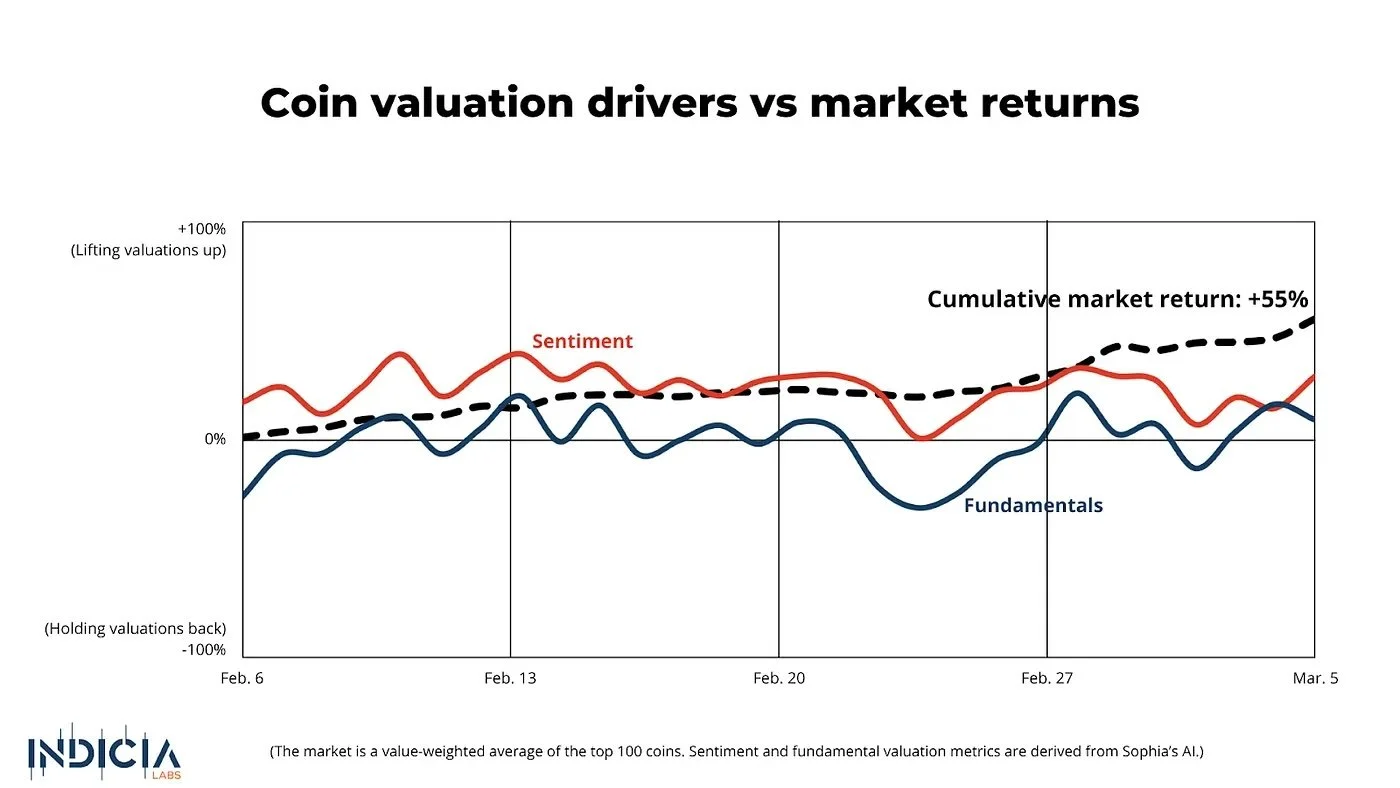

Over the last week, Sophia measured an improvement in the valuation lift provided by crypto fundamentals. At the same time, sentiment continues to provide strong fuel for crypto valuations. This appears to be a good recipe for the market. The market gained 21% in the week that ended yesterday. Over the last 4 weeks, the crypto market gained 55%.

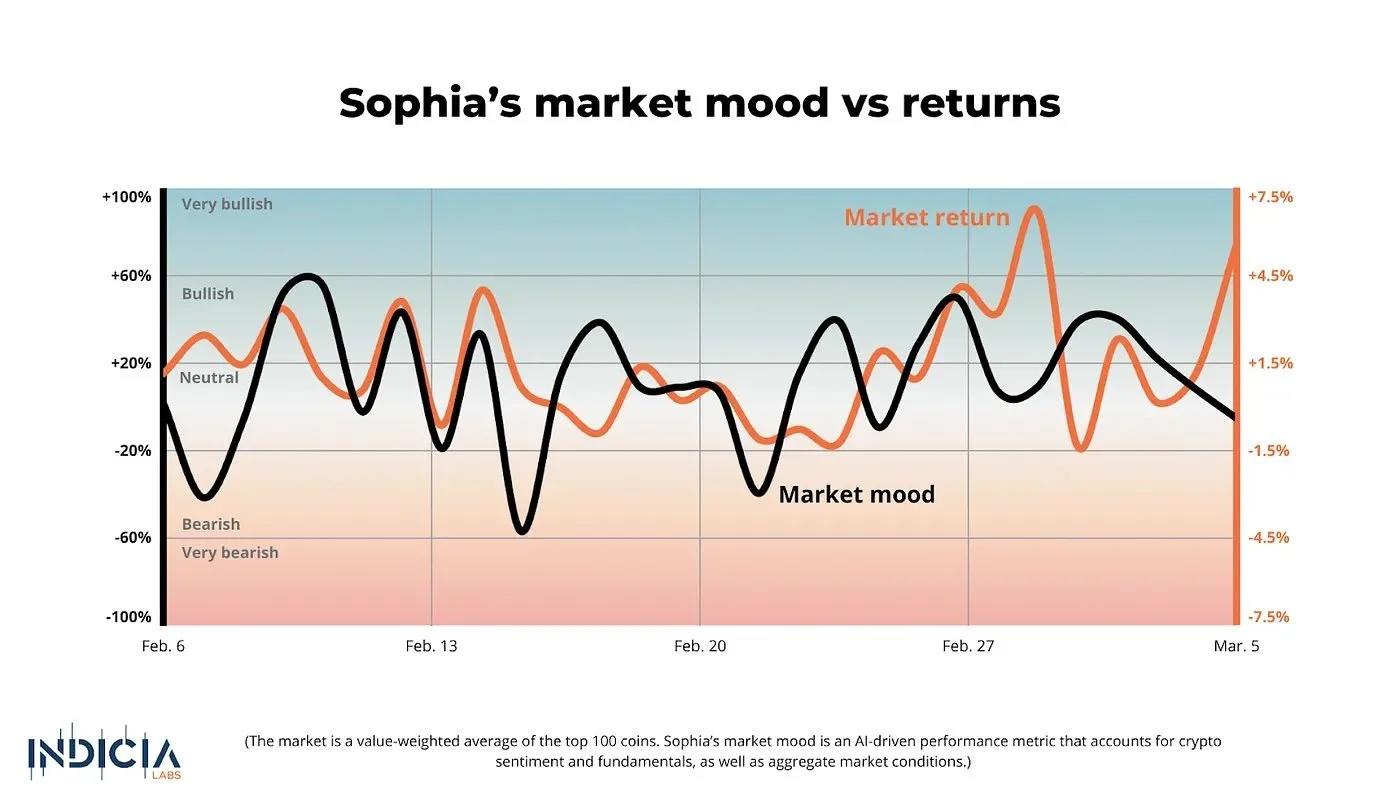

Despite the push from fundamentals, Sophia’s mood for the crypto market mostly fluctuated between neutral and bullish last week. The accuracy of Sophia’s mood signal for individual coins was 60% last week.

Even though the market cooled off today and retracted from its peak, we do not anticipate that the 2024 rally is done yet. There are several events in the horizon that will likely keep sentiment going strong and further improve crypto fundamentals:

The Bitcoin halving that is expected in April. It is anticipated to have a positive impact on the crypto market.

The possible approval of spot Ethereum ETFs. We will learn more news about this in May. We believe that the anticipation that the SEC may approve another set of spot crypto ETFs will further fuel crypto sentiment.

So, buckle your seat belts, because the 2024 rally is just getting started.

Do you want to stay up-to-date on the latest crypto intelligence? Use the offer code ILxYOU to join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.